“An investment in knowledge pays the best interest.” — Benjamin Franklin

Bad counsel has been determined to be hazardous to your financial health. Because, knowledge is the shortest distance between poverty and wealth.

Warning: Fake News 📰 Anyone who has heeded Wall Street or so-called Financial Gurus have missed out on gold’s record run in 2020 – and decades of Extraordinary returns.

The Trade of Two Decades 💰

The “anti-gold” media reveals a deep-seated bias that can only be explained as irrational or dishonest.

Over the last 50 years gold has been the best performing Financial asset, outperforming stocks, bonds, real estate and every other investment class by a wide margin.

In fact, even after the longest stock bull market in American history, stocks have lost more than 60% of their of purchasing power versus gold since 2001. It took 42 oz of gold to buy one share of the Dow 20 years ago, today only 17 oz of gold.

Financial Advisers Don’t Get Paid Fees Recommending Physical Gold

It’s no mystery why many who work in the financial industry hate gold. They are in the business of pushing paper assets, and physical precious metals held outside of bank and brokerage accounts generate no fees for them. Financial professionals concoct various rationalizations for why gold is a bad investment.

Real News 📰 The respected firm Ibbotson Associates ( part of investment analytic giant Morningstar) found that investors who put 7.1% to 15.7% of their portfolios in precious metals enjoy superior risk-adjusted returns.

Gold shows virtually no correlation to stocks and bonds, meaning it can rise when paper assets fall. That’s why economists have long recommended portfolio diversification, and that 10% to 20% of investors assets be devoted to gold and silver as Financial Insurance.

Yet, gold is still the most under owned investment asset in America, 90% of households don’t own any physical gold. And the average investor has nowhere near even the bare minimum suggested by Ibbotson Associates to hedge against risks in financial assets.

Meanwhile, investors are bombarded with misinformation about gold from Big Finance and popular personal finance gurus.

Economist Stefan Gleason writes…“Millions of people have turned to Dave Ramsey for financial guidance.” Unfortunately, while some of his tips about managing household finances responsibly may be sound, he doesn’t seem to have a clue about sound money itself.”

In a conversation posted to YouTube last year with a caller who inquired about gold, Ramsey said, “It is a golden colored rock. It has no intrinsic value except for the fact that two people are fighting over it. And that’s the only thing that gives it value – the same exact thing that gives a green piece of paper with a president’s face on it value.”

In fact, gold is unlike any fiat currency in that it does have intrinsic value! He doesn’t understand the biblical principle of sound money. “God called gold “Good.’ He created gold so that we would have an honest method to transact business, and to store savings in a form that would not depreciate over time, and a means to save for future needs by acting as a store of value – one that does not allow man to rob the people through currency debasement and inflation.” – Doug Tjaden, author – “Fools Gold.”

Robert Kiyosaki, author of the best-selling Financial book of all time ‘Rich Dad Poor Dad’ says… “Gold is God’s money.” He clearly understands the unique role gold plays, as honest money and a store of value.

We are called to be good Stewards of the resources we’ve been entrusted with. Learn what the Bible says about gold and silver at: https://www.libertyfinancial.org/what-the-bible-says-about-gold-silver/

Gleason continues…“Gold historically has retained its purchasing power better than any paper currency ever invented.” Yet Ramsey claims, “It has a crummy track record as an investment.” He has a crummy grasp of recent history.

From 2000-2010, gold gained a cumulative 280%. But for the stock market, it was a lost decade. The S&P 500 actually fell 24% over that same period.”

His recommendation to invest and save in the stock market ( via mutual funds) without portfolio protection (gold & silver) can be a costly mistake. During the last financial crisis of 2008, investors and Savers lost up to 70% of their retirement-savings when the stock market crashed. While those who had gold and silver kept their portfolio values intact.

Since 1929 there have been 20 major stock market crashes, about one every 5 years, with an average fall of 36%. In each case gold has held its value or appreciated greatly.

“Incredibly,” Dave Ramsey asserts on his web site, “Since the dollar isn’t backed by gold anymore, investing in this precious metal won’t help you if inflation hits.” That statement is so nonsensical, it seems Ramsey experienced some sort of mental glitch when writing it.”

The whole point of gold as investment is that it serves as a hedge against an unbacked dollar. Gold protects your retirement-savings from asset bubbles, stock market declines, global unrest and inflation. ( currency debasement )

During the decade of the 1970s, as paper assets got clobbered by inflation, gold delivered average annual returns of 30.7%. The S&P 500 barely eked out nominal gains of 1.6% per year – which were far too puny to keep pace with an inflation rate that surged into the double digits by the end of the decade.

Looking longer term, gold has risen almost 10,000% – from $20 to nearly $2,000 per ounce – since 1930, priced in America’s depreciating fiat money.

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. Gold is a currency. It is still, by all evidence, a premier currency, where no fiat currency, including the dollar, can match it.” – Federal Reserve Chairman, Alan Greenspan. ( 1987-2006 )

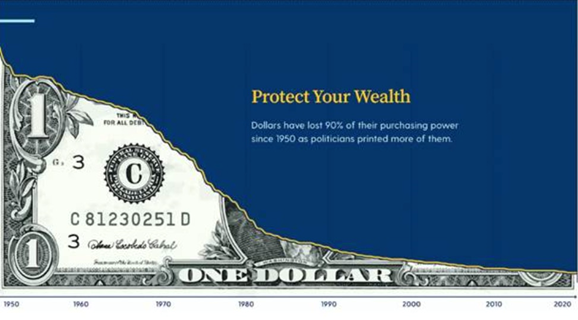

Warning: Fake Information 📰 The Consumer Price Index has been diluted to cover up the real rate of inflation. The true rate of inflation is well over 10%, more than double the understated official rate. ( chart below ) The government removed basic items like food and energy costs years ago, to hide inflation and keep consumer confidence in the U.S. dollar. (Fiat Currency) That means any cash you have in the bank right now is losing more and more of its value each day.

Real Information 📰 “Tangible Assets are Cheap,” says Bank of America, adding that “it’s time to finally invest big on diamonds, precious metals, real estate, art, vintage cars, and other collectibles.” The bank’s analysis showed that real assets are at their lowest level since 1925 relative to financial assets, such as stocks and bonds.

Warning: Fake Money 💵 Media “Gurus” promoting Bitcoin and other cryptocurrencies also feel compelled to bash gold.

Grayscale Investments, which operates an exchange-traded Bitcoin product, went so far as to launch a “drop gold” campaign. It produced an anti-gold TV commercial than has aired frequently on CNBC. The ad portrays gold buyers as “living in the past” and out of step with the “digital world.”

Cryptocurrency enthusiast James Altucher claimed in an interview, “Gold is just a rock. Bitcoin has real value.”

But barely ten years old, cryptocurrencies are much more volatile than gold and have nowhere near its historical track record of maintaining value. Bitcoin could conceivably be worthless in a few years’ time if new technologies supplant it. And governments could also impose new regulations and restrictions, which could also burst the cryptocurrency bubble.

Warren Buffett, the most successful investor in Wall Street history, has called Bitcoin ‘rat poison’ with no intrinsic value and calls it the largest financial bubble in history.

Real Money 💴 Gold on the other hand, is a basic element that can’t be digitally replicated or replaced. And it still functions without a computer or when the power goes out.

Gold has been valued and used as money for thousands of years. And central banks today are accumulating gold at a record pace.

Unlike a fiat currency, gold’s value can never be hyperinflated away. Unlike a bond, it can never default. And unlike a publicly traded company, it can never go bankrupt.

That’s why, throughout history gold has been the most sought-after form of asset protection. It’s value cannot be debased by governments who print paper money at will, making their currency worth less every year.

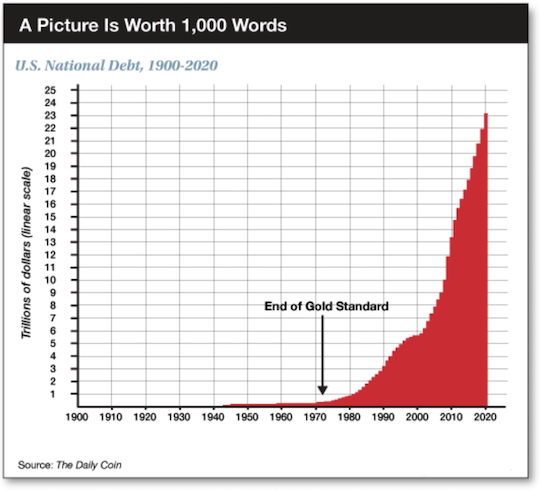

In 1971 the U.S. government abandoned the gold standard, even though the Constitution declared that gold & silver were to be the only money allowed by law. During the last 50 years, while the U.S. dollar has lost 90% of it’s purchasing power, gold has increased 58 times in value.

Never forget that anything denominated in dollars (stocks, bonds, CD’s) loses value with each passing month.

Overvalued Equity markets and a monetary system overcome with indebtedness, is not a safe place to entrust your financial future. In today’s uncertain economic environment it’s wise to seek out proven assets in order to preserve and increase one’s wealth.

Prudent investors are wisely diversifying their retirement-savings out of the unstable equity markets, into the safety of gold & silver for long-term appreciation and protection.

As gold values continue to rise against the falling dollar, there has there been a greater opportunity to safely grow your wealth and protect your assets from the ongoing dollar devaluation.

Since 2009 our national debt has exploded from $9 to $28 trillion dollars, hyper-inflating the stock and bond markets, and creating the largest financial bubble in history.

In 2021 the stock market make get cut in half and your dollars in the bank will lose much of their value. But, gold & silver will continue to create wealth, provide asset protection and safely grow your retirement-savings, as they have done for thousands of years.

American rarities offer unparalleled profit potential, a proven track record of appreciation, privacy and wealth preservation. By starting today you will be taking one of the most important steps in securing your financial future.

Better than Bullion – Guaranteed Gold.

Classic American gold coins are the best way to store, preserve, and increase your wealth. Today, there is unprecedented value in these beautiful tangible assets.