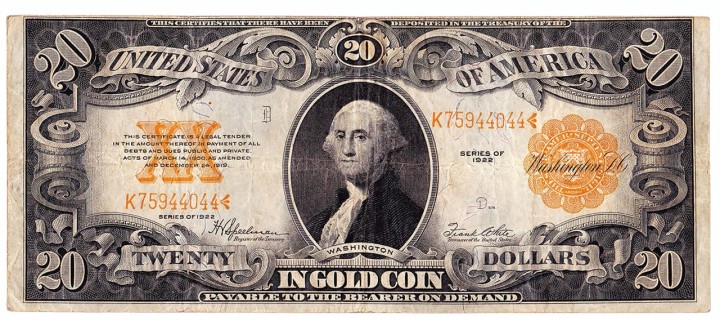

1933 was the last year U.S. currency was redeemable in gold.

“Paper money has had the effect that it will ever have. To ruin commerce, oppress the honest, and open the door to every species of fraud and injustice.” – George Washington

The U.S. dollar has been the world’s Reserve currency since 1944… But in 1971, the U.S. Government broke its constitutional promise and nearly 200 years of sound money that began in 1787. This ended both the gold standard and the limit on the amount of currency that could be printed.

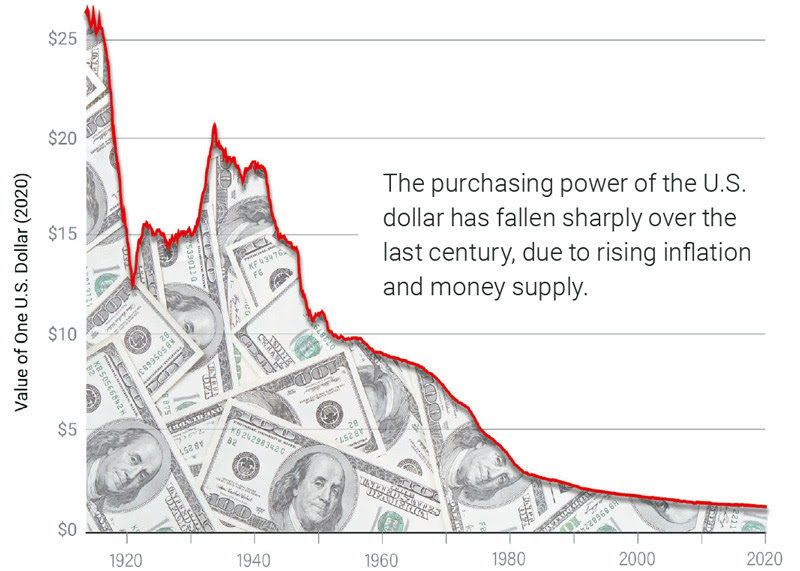

This has resulted in the U.S. dollar losing over 90% of its purchasing power during the last half century (while gold has increased 58 times in value)

Now, after 50 years of Reckless money printing by the Fed, the U S. Dollar as the world’s reserve currency is about to change… A rush to the exit in the U.S. dollar (fiat currency) has began.

The Great Dollar Disaster.

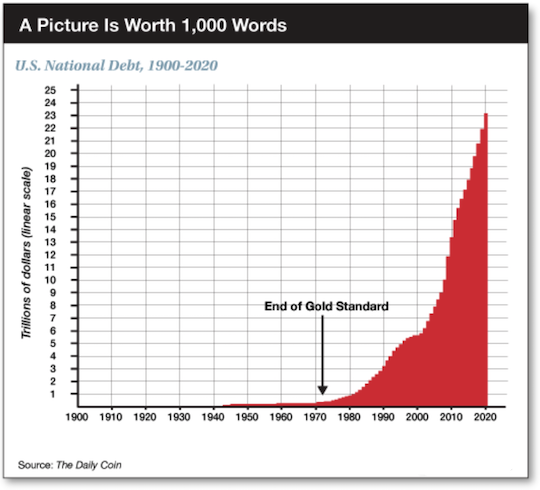

It took more than 200 years for the U.S. to reach $1 trillion in debt. But in the last few years our debt has soared, turning America from the worlds largest creditor into the worlds largest debtor. Federal debt has more than quadrupled since the Great Financial Crisis of 2008.

Since 2009 our national debt has exploded from $8 to $31 trillion dollars, hyper-inflating the stock, bond and real estate markets…And created the largest financial bubble in U.S. history, (Now deflating)…

The truth that Washington doesn’t want you to know 💵

To fund Washington’s out of control spending the Federal Reserve — has created over $23 trillion out of thin air since 2009. The “official” U.S. national debt is now over $31 trillion — nearly 4 times more than the most indebted nations in Europe … COMBINED. But when you add in the debts Washington owes to veterans, seniors and government pensioners, the total amount is 5 times more: A staggering $182 trillion! That’s 8 TIMES the total value of the goods and services the U.S. economy produces …That’s far more debt than Washington can ever hope to pay.

In fact, Washington’s only hope of avoiding default is to debase the value of the dollar to repay it’s unpayable debts with cheaper dollars that are only a shadow of their former selves. Throughout history, this is how governments deal with excessive debt by debasing the currency, via inflation AKA stealth default, thereby robbing investors and savers.

For decades the greenback served as the worlds reserve currency. Backed by the full faith and credit of the U.S. Government. This role has created immense demand for U.S. dollars, that constitutes a HUGE part of the dollars valuation. And has also created an almost endless pool of demand for U.S. treasuries and enabled the American federal government to borrow without limit and spend without abandon…

The value of the U.S. dollar is based on this role as the conduit for global trade. When that role vanishes, as is happening now, much of this value will evaporate.

U.S. government backing was a powerful guarantee when America was on the ascension. Unfortunately, somewhere along the line, Congress began perpetual deficit spending and Federal Reserve bankers launched a Zero Interest Rate Policy, monetizing Treasury and inventing other reckless monetary expansions.

Dollar depreciation (inflation) is a direct consequence of financing endless wars, and a wave of bail-outs within a system that privatized profits and socialized losses. The full faith and credit guarantee means a lot less now.

After years of abusing its reserve currency status, the United States now faces a growing wave of global de-dollarization. As many of the largest and most populous countries in the world are banding together to launch a U.S. dollar (USD) alternative to be used in global trade.

China, Russia, Iran, India, Japan, Brazil, Saudi Arabia, France, and other countries …are ditching the dollar. In fact, The U.N., the IMF and other international organizations … have called for the end of the dollar’s reign as the world’s reserve currency. And the need for a new global reserve currency independent of the dollar.

BRIC Nations to introduce New Global Currency backed by Gold to replace the dollar 🇨🇳

The Chinese gold-backed digital yuan or Russian rubles. Countries increasingly do not trust each other’s Fiat currencies. However, they do trust gold and silver.

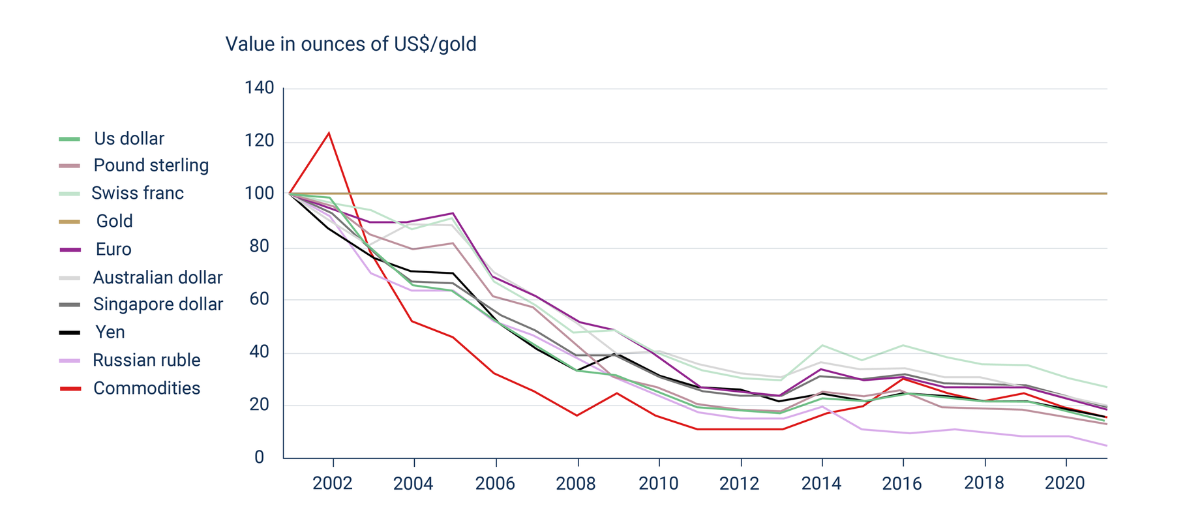

Over the past 20 years, paper money has lost an astonishing 80% of its value compared to gold!

The Chinese are speaking to over 149 countries about joining a gold-backed currency to take down the U.S. being the global reserve currency. China has been brokering deals with Russia, Iran and Saudi Arabia. Several nations have expressed interest in joining the bloc, including Algeria, UAE, Mexico, and Nigeria.

And for the first time in 48 years, Saudi Arabia said that the oil-rich nation is open to trading in currencies besides the U.S. dollar.

This could mark the beginning of the end of petrodollar exclusivity. And in March, Reuters reported that recent oil deals between India and Russia have been settled in currencies other than dollars.

The Biden Administration has weaponized the U.S. dollar via sanctions that has triggered the de-dollarization. In response more countries are moving to escape.

Former Goldman Sachs chief economist Jim O’Neill, the person who coined the term BRICS — representing Brazil, Russia, India, China and South Africa — said that the trading bloc should expand and challenge the dominance of the U.S. dollar.

“The U.S. dollar plays a far too dominant role in global finance,” he wrote in a paper published in the Global Policy journal. “Whenever the Federal Reserve Board has embarked on periods of monetary tightening, or the opposite, loosening, the consequences on the value of the dollar and the knock-on effects have been dramatic.”

Since year 2000, the United States dollar has lost 12 percentage points of market share falling from 71% to 59%, according to the International Monetary Fund. The world is quickly moving towards a multipolar system as the U.S. dollar sees its role as a reserve currency weaken.

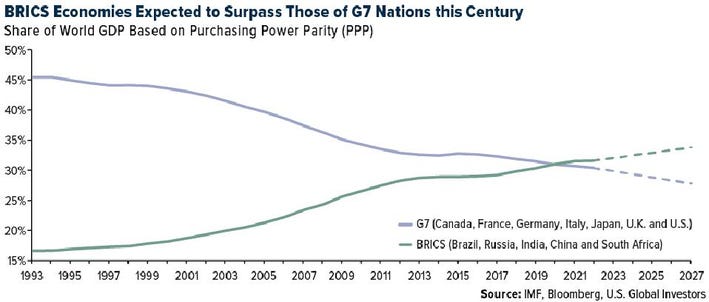

BRICS nations are now the world’s largest gross domestic product (GDP) bloc when taking purchasing power parity into account, according to data from Acorn Macro Consulting.

BRICS now contribute 31.5% to the global GDP. Moreover, that figure propels the collective ahead of the G7, which sports a global GDP of just 30.7% comparatively.

Confidence in the greenback continues to erode thanks to the profligate borrowing, spending and money creation by the U.S. government.

Uncle Sam depends on the demand for dollars to underpin its profligate borrowing and spending. The only reason the U.S. can get away with massive budget deficits and an ever-growing national debt to the extent that it does is the dollar’s role as the world reserve currency.

If the demand for dollars tanks, the greenback’s value will quickly erode away. That means even worse price inflation for Americans. And in the worst-case scenario, it could collapse the dollar completely.

In fact, losing its spot as the world’s reserve currency, would cause a brutal downturn in the U.S economy, much worse than the mortgage crisis of 2008, As banker James Rickert said in his best selling book “Currency Wars” “When the currency collapses, everything else goes down with it..stocks, bonds, derivatives and other dollar denominated investments.” And trillions of dollars of perceived wealth in IRA/401k retirement accounts could vanish overnight.

Fiat Currencies

All governments around the world, including ours, have printed massive amounts of paper money backed by nothing but debt ( fiat money) that can never be repaid.

In an intriguing study done by dollardaze.org on 775 fiat currency’s, determined that: “There is no historical precedence for a fiat currency that has succeeded in holding it’s value” In fact the report showed that the average life expectancy for fiat currency is 27 years and the survival rate of all fiat currency’s is zero.

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value. Gold is a currency. It is still, by all evidence, a premier currency, where no fiat currency, including the dollar, can match it.” – Federal Reserve Chairman, Alan Greenspan ( 1987-2006)

Gold is the biggest winner as the world diversifies away from the U.S. dollar. We have already seen proof of this.

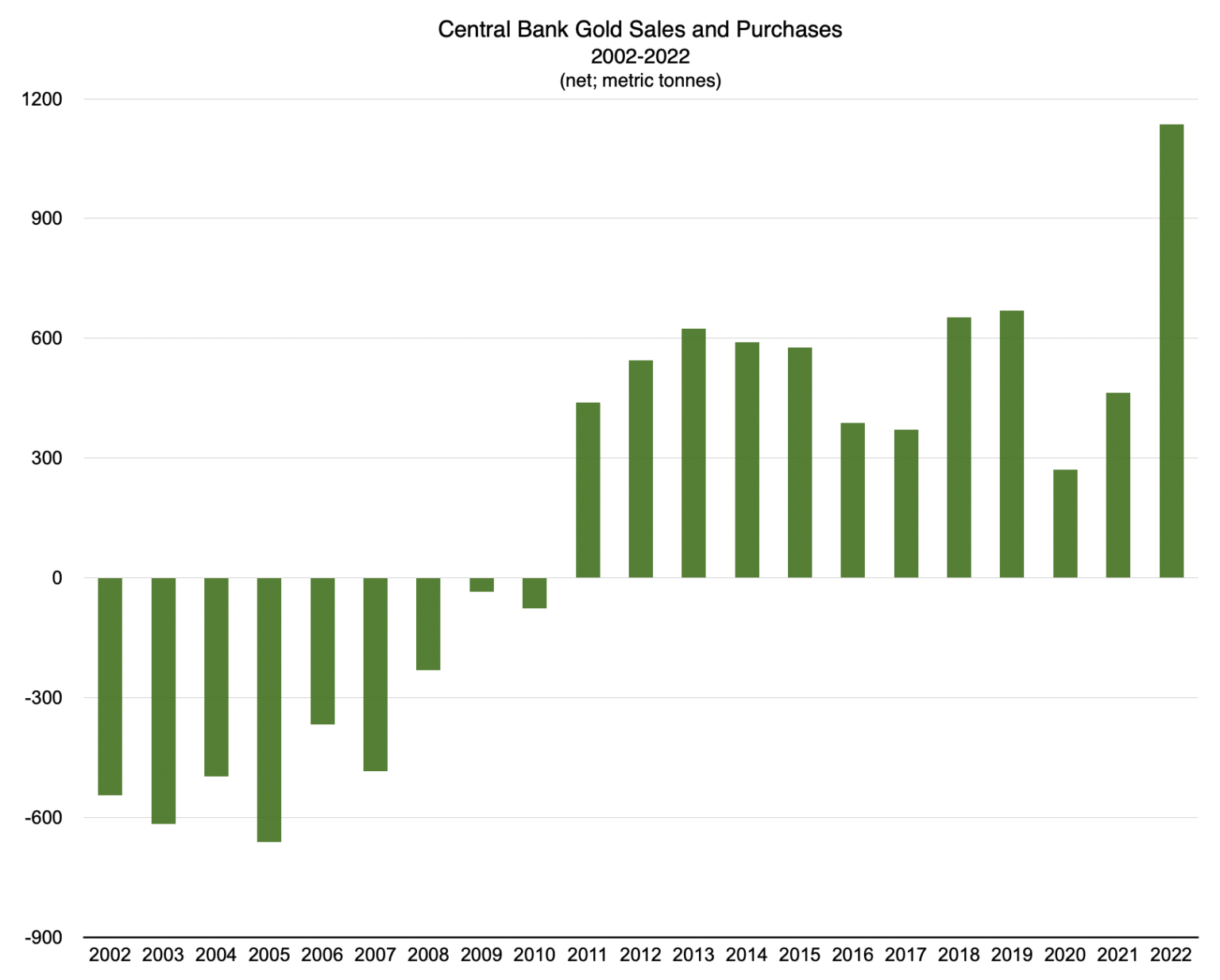

In 2022, central banks bought a record 1,136 tonnes of gold to diversify their foreign reserve holdings. Analysts expect central banks to continue buying gold en masse…

The Great Gold Rush: Central Banks in Frenzy 🏦 In 2022 central banks bought the most gold in 50 years, since the U.S. dollar went off the gold standard. (1971)

Data source: World Gold Council.

“Gold is the anathema to a fiat-based monetary system. Record gold purchases by central banks are a red flag regarding the stability of our current monetary system. When central banks embrace gold, it is an indicator that they are losing trust in the current system. “

Bank gold demand, with China as the leader in the 2023 marketplace, has generated new bullish sentiment: Kitco News 🏦 China’s central bank put the world on notice as it buys more gold; The country bought 24.9 tonnes of gold in February.

China will continue to publish its gold purchase as it looks to establish a new international currency, competing with the U.S. dollar as the world’s reserve currency.

“It’s no coincidence that China has just started to publish their gold purchases again. They are putting the world on notice that they have an international currency,” said the World Gold Council.

Western nations’ weaponization of the U.S. dollar by seizing $600 Billion in dollar reserves, as a rebuke of Russia’s invasion of Ukraine has sped up the dedollarization trend. MarketWatch.com, said they also expect China to continue to add to its reserves, highlighting the dedollarization trend.

“Gold will be an important strategic asset for central banks and investors need to pay attention.” And see gold prices pushing back to record highs this year in part because of central bank gold demand.

“China will continue to increase its official gold reserves.” They added that the country holds a lot more gold than it is reporting, as the nation is the world’s biggest gold producer and a lot of domestic companies are state run.

“Investors shouldn’t underestimate China’s push to create an internationally recognized currency to complete with the dollar.”

Billionaire John Paulson: Central banks are replacing dollars with gold, you are better off investing in precious metal than USD /Kitco News.

Gold will increase in value while the U.S. dollar drops, said Paulson & Co. founder. And that is the hedge fund manager’s outlook for this year, the next 3 years, and the next 5 years.

“There has been a significant increase in demand from central banks to replace dollars with gold, and we’re just at the beginning of that trend. Gold will go up and the dollar will go down, so you’d be better off keeping your investment reserves in gold at this point.”

He highlighted the de-dollarization trend and noted that with inflation fears and new geopolitical tensions. The U.S. also has an enormous deficit with the rest of the world in terms of trade and investment balances that used to be very positive, but now it’s very negative.” Pointing to massive money printing, fiscal spending, previous quantitative easing, and inflation. Gold represents a legitimate alternative to the greenback and other fiat money.

“We’re at the beginning of trends that are going to increase the demand for gold, and inflation and geopolitical tensions will determine the rate at which gold increases. This year gold will appreciate versus the dollar, and also over a 3, 5, and 10-year basis,” he said.

Bloomberg, thinks cash holdings, which CNBC reports at near-record levels, are another dead end for investors. “If you are holding cash, it is only a temporary king.” says that inflation, which erodes the value of cash, “will be with us for the long haul and that investors should look to gold as an alternative.”

Gold has consistently kept pace with the decline in the dollar’s purchasing power over the long run and has risen rapidly during times of economic distress.

INFLATION WILL PLUNGE economies back into the recessionary depths of the 1970’s and have “adverse effect on working people everywhere,” former U.S. Treasury Secretary Larry Summers warned in a recent Bloomberg article.

Ray Dalio, who runs the world’s largest hedge fund, Bridgewater & Associates said, “Governments have run up very large debts and have developed a dependence on their central banks to print money to buy the government debts,” he said. The increase in debt monetization “will mean that holders of debt assets will get bad inflation-adjusted returns.” Dalio is a long-time advocate of gold ownership.

“The Federal Reserve is in the 9th inning and inflation is not going down and that will drive gold higher.”

Inflation remains the biggest threat to investors, and it’s impossible the Federal Reserve will be able to get it back under control, much less under 2% again. It’s aggressive interest rate hikes have finally broken the fragile banking system.

The end of the ‘everything bubble’ has finally hit the banking system. Credit Suisse and SVB might be just the first of many shocks. – MarketWatch 📰

The immediate cause is the rapid increase in official interest rates in the U.S. and other major global economies. The true cause is the unwinding of an economic and financial structure built upon an artificially low cost of money, which gave rise to the “everything bubble” and its leveraged speculation.

The demise of Silicon Valley Bank and Signature Bank was just the tip of the iceberg. As it turns out, hundreds of banks are at risk. This explains why the Federal Reserve and U.S. Treasury rushed to provide what is effectively a bailout for the entire banking system. In the first week, the Federal Reserve handed out more than $300 billion

“The federal government effectively took on an extra $7 trillion in unfunded liabilities. (The total of uninsured bank deposits.) Massive inflation is going to be created to pay for these bailouts. A return to quantitative easing. Gold prices are going to go through the roof. That means the purchasing power of bank deposits is going to fall through the floor.” – Peter Shiff.

Sprott’s John Hathaway, believes the Fed will be forced to abort its anti-inflation mission by “exigent circumstances.” When it does, investors will return to gold as a safe haven asset. “Dollar ‘strength’ is a mirage,” he says. “It is the reverse image of all other paper currencies’ weaknesses. In our view, the dollar ‘wrecking ball’ may well represent the last stand for paper currencies in general, all of which are the ever-increasing issuance of fiscal decay.”

Decades of Zero Interest Rate Policy, QE, and risky fractional reserve practices have consequences.

The Great Financial Reset 🌎 We are witnessing the beginning of the end of the world’s current fiat monetary system. For more than a half century (1971) world governments have printed unprecedented amounts of paper money, making the value of their currency worth less each year.

But massive currency devaluation (inflation) is now forcing central banks to return to a gold standard again. To forestall the inevitable collapse of the world’s paper money system.

The world is in the midst of a ‘significant macroeconomic reset’ and gold is the ‘shining star’ – Bloomberg Intelligence.

Bloomberg Intelligence is projecting “a severe global economic reset,” with gold set to be one of the top commodity assets this year.

“Next year, we are going to look back at these gold prices as a bargain. We will see this as the start of when prices really exploded,” he said. “We are very close to pivot in the global monetary system.”

Gold is the primary global currency. It is the only currency, along with silver, that does not carry any counterparty risk. (Government)

Unlike a fiat currency, gold’s value can never be hyperinflated away. Unlike a bond, it can never default. And unlike a publicly traded company (stock) it can never go bankrupt.

Time and again throughout history, gold has been revalued to account for the numbers of dollars in existence. Which means gold will trade at multiples of its current value in the months and years ahead.

Chart above shows gold has to nearly double in price to $3,893/oz, just to catch up with Fed money printing.

The gold price is beginning to reflect the strains on the monetary system, advancing to within striking distance of a new record, despite the most rapid rise in interest rates seen in decades.

Since 2008, the evidence is mounting that the fiat currency system is on the verge of collapse. People can feel it. They are working harder for less. But the Federal Reserve doesn’t want you to believe it’s happening. Yet, a currency crisis is a mathematical inevitability.

The Great Dollar Devaluation 📉

Independent Living newsletter reported, “Anyone holding dollars or dollar denominated assets is sitting on a ticking time bomb and there isn’t a moment to lose before something triggers a rush to the exits.”

“A massive catastrophic dumping of the U.S. dollar has began as major foreign investors such as China have caught on to the hard reality of us insolvency and come to the inescapable conclusion, that the only way Washington can keep its Ponzi finances going is by running the printing presses Non-Stop.”

Since the U.S. government must continue borrowing just to pay interest on previously issued debt, the only way the government can keep its Ponzi scheme going is by constantly devaluing what it owes. That means making sure inflation stays elevated above nominal rates.

Even Mega investor Warren Buffett recently admitted publicly; “The Frantic spending and money creation that’s happened will cause, the U.S to experience a currency destroying inflation that is going to be much more severe than in the 1970’s.”

That is why billionaire investors such as Jim Rogers, have used the temporary deleveraging driven dollar rally of recent months to evacuate their assets out of Harm’s Way. Before, as he puts it, “The dollar goes the way of the pound sterling and declines by 90% in the coming years.”

And the always reliable Casey report added, “The day of the paperback dollar is coming to an ugly end and soon.”

Nobel economic Prize winner Dr Paul Samuelson, hardly an alarmist, said: “U.S. Financial imbalances are so severe and irreversible, that we must accept that at some future date there will be a run on the dollar. Probably the kind of disorderly run that precipitates a global financial crisis.”

Former U.S. Congressman Dr Ron Paul recently noted about the rampant unprecedented money creation. “The trillions and newly created bailout dollars courtesy of U.S. Treasury and the Federal Reserve, will precipitate an inflation tsunami and destroy the dollar.”

Founder of Equity Management Associates (EMA), shared his prediction about the demise of the U.S. dollar in an interview with Kitco News said, “We expect the U.S. Dollar to Lose Most of Its Value in 5-10 Years.”

Financially The U.S. is on a Road with No Turns.

We are witness to the end of a 52-year experiment in which the global currencies linked to the dollar, and with no gold backing anywhere, are reaching the final inevitable stages of all Fiat money. When the Weimar Republic and more recently the Zimbabwe began to monetize their debt the country’s plunged into hyperinflation.

In short the U.S. is printing its way out of debt. And that means the value of the dollars that you hold are destined to go down significantly.

The Stampede out of the dollar has already began. Gold is the mortal enemy of big government borrow and spenders. When the gold price shoots up, it signals to the world that the currency upon which government Ponzi finances operate is losing value.

Why You Must Not Fall for the Illusion of Sector Diversification.

Your broker and the Wall Street Media tout the value of diversification. But diversification is limited to Dollar denominated stocks and bonds. Never forget, anything denominated in dollars loses its purchasing power with each passing month.

Example: The stock market has been collapsing against the value of hard assets over the last 20 years. In spite of the biggest stock bull market in history ( 2009-2022 )

It currently takes about 14 oz of gold to buy a share of the Dow Industrial. Yet in 1999 it took 45 oz of gold to buy a dow share. That’s nearly a 70% crash in real value of the Dow!

“Washington can fool millions of investors on the short term. But they can’t fool those who measure their wealth in terms of precious metals, which retain their value over time.”

With Federal Reserve Note “dollars” now facing the twin threats of inflation and bank failures, more Americans than ever are diversifying into physical gold and silver.

Central Banks are Dumping Dollars & Buying Record Amounts of Gold.. Are You?

A global banking crisis, impending recession, and persistently higher inflation. Now we can also add the demise of the U.S. dollar as the world’s reserve currency, are the reasons why owning gold is a critical step to preserve retirement savings.

Gold is considered to be a “Tier 1” asset in the global banking system. In a world of depreciating fiat currencies, gold is the ultimate money.

Americans are learning there are alternatives to lending their savings to irresponsible banks — and they are increasingly diversifying into tangible monetary metals (which do not rely on anyone’s promise to pay)

It is dangerous to own risk assets such as stocks at artificially inflated valuations. It is especially dangerous to own false safe havens such as bonds, when their yields are so low that they are guaranteed to deliver negative real returns. (inflation)

Inflation when properly calculated, is over 10% so a 5% nominal return translates into a 5% real loss!

Wharton business school professor Jeremy Grantham has warned the implosion of an “everything bubble” could tank the S&P 500 by up to 50%, and plunge the US economy into a painful recession.

The prices of stocks, bonds, real estate, and other investments ballooned to unsustainable highs during the pandemic.

Grantham said a recession is inevitable when a “superbubble” pops, and the ensuing downturn is worse when the speculative frenzy affects multiple asset classes.

These are the times when precious metals excel as safe haven assets. Gold has maintained its value over time better than any other asset on earth. That makes it the best place to store your wealth. It’s the only true safe harbor for your investments, and should be a major part of every investors portfolio.

Investors have been diversifying with gold and silver for centuries to limit their exposure to poorly executed monetary and fiscal polices.

As history shows over the long term, gold retains its purchasing power better than fiat cash or debt in any form. It has stood the test of time as the longest reigning hedge against inflation, economic turmoil, and uncertainty in the global financial markets.

Forbes-Time Could Be Running Out To Buy Gold At These Prices 💴

Emergence Of A Multipolar World And Rapid Dedollarization & Acceleration Of The Liquidity Crisis And Return Of Quantitative Easing (QE) “If you’re underexposed or have no exposure, time could be running out to get in at these prices.”

Gold & silver markets have produced spectacular returns during periods of relatively high, and rising, nominal interest rates. That’s exactly what happened during the inflationary 1970s, as gold values increased 20 times during the decade. While stocks and real estate prices collapsed.

Tangible Investments offer unparalleled profit potential, a proven track record of appreciation, privacy and wealth preservation. They’re the perfect way to protect yourself against inflation and the risky stock market.

During the Great Recession in 2008 and 2009. The value of more common stores of wealth like stocks and real estate plummeted. But during that time the price of gold nearly tripled in price, while silver soared 500%.

Since 1982 Liberty Financial has helped thousands of American Secure their financial future by rolling over their IRA/401K out of the risky stock market into tangible Investments, that provide a safe and predictable way to build wealth and protect retirement savings.

Our commitment to excellence, award-winning advice and unmatched customer service, has earned us a top consumer investment rating. Making us the wise choice for tangible investments.

Don’t miss out on the last great buying opportunity in the world’s cheapest asset. Use the great dollar devaluation to make once in a generation gains, with no-Risk in Liberty Financial’s Guaranteed IRA & Gold coins.

🛡 Physical Gold. Always Liquid. IRA/401k Approved. Guaranteed Risk-Free. Only $10,000 minimum.

https://www.libertyfinancial.org/certified-gold/

CALL TODAY

800-723-8349

Text (949) 274-9538 📱

LibertyFinancial.org 💻

🗽Trusted Advice. Proven Results. Guaranteed Security. Since 1982