Fall 2021 🍁

There is a season for everything. – Ecclesiastes 3:1

There’s a reason why a growing number of billionaires — like Paul Singer, Sam Zell and Ray Dalio — have increased their holdings in gold over the past several month’s.

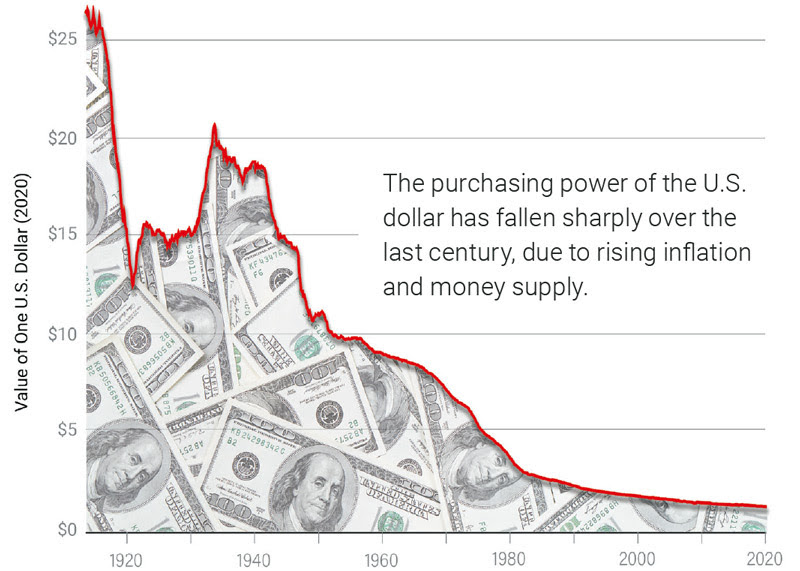

Over the last year the dollar has lost almost 10% of its purchasing power due to currency debasement. (inflation )

Inflation is much higher than the “official” CPI numbers. The government removed basic items like food and energy costs years ago, to hide inflation and keep consumer confidence in the U.S. dollar. (Fiat Currency) That means any cash you have in the bank right now is losing more of its value each day.

Source: Bureau of Labor Statistics – Consumer Price Index.

Legendary investor Sam Zell said he was driven into buying gold despite years of talking down the metal.

The 79-year-old American billionaire & founder of the Equity Group said concerns about fiat currency made him buy gold. “When you see the debasement of the currency, you say, ‘what am I going to hold onto?'”

Zell said, “The U.S. is not the only country that is printing too much money. The natural reaction is to buy gold, which I’ve actually done for the first time.”

John Paulson, the billionaire hedge fund manager who executed the “greatest trade ever” in 2007 is now pounding the table about the opportunity in hard money.

“The greatest opportunity today is to trade out of paper and digital assets and into hard assets. There is a very limited amount of investible gold compared to an ever-expanding money supply.” priming the monetary metal for its moment.

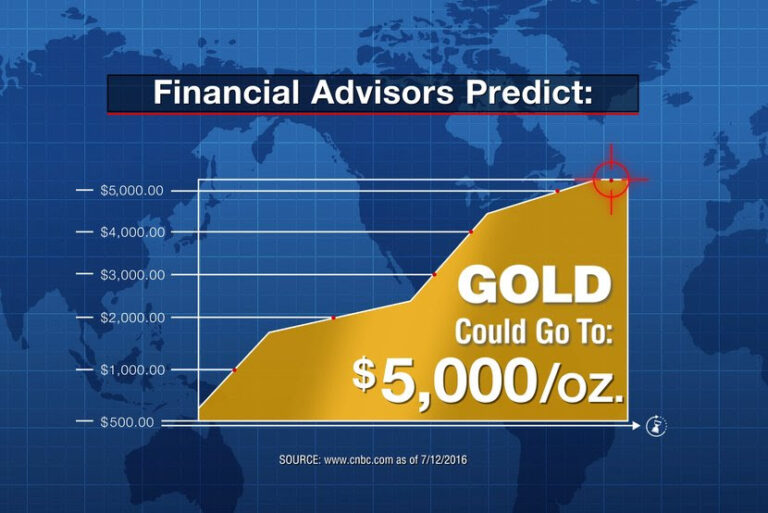

He anticipates that gold prices will be squeezed to the upside as investors exit low-yielding cash and fixed-income instruments in search of inflation protection.

“As an investor I became very concerned about having my assets denominated in U.S. dollars, I looked for another currency in which to denominate my assets. I feel that gold is the best currency.”

Billionaire investor Jeffrey Gundlach just suggested that gold is going higher, a lot higher.

Among other potentially bullish catalysts, the “Bond King” sees the Federal Reserve note declining further, leading to a big rally in gold once it breaks out of its recent trading range.

Meanwhile, Steve Forbes, Chairman and editor-in-chief of Forbes Media, also believes great days are ahead for the yellow metal.

Forbes recently discussed a variety of issues that support higher gold prices. He warned that massive sovereign debts combined with ultra-low interest rates are going to have a major impact on global financial markets in the years to come.

Ray Dalio who manages the world’s largest hedge fund, Bridgewater and associates, noted that the recent fiscal and monetary stimulation of such magnitude is unprecedented during peacetime. “We’ve had a few such periods of extraordinary stimulus over the past century—all in times of economic depression, conflict, or both—and in all of them, gold saw triple-digit rallies.”

Renowned Billionaire Paul Singer says that gold is currently one of the most undervalued assets.

According to Singer, price of the precious metal could double, due to “Fanatical debasement of money by all of the world’s central banks.” His hedge fund Elliott Management is one of many betting big on gold.

“The stock market may get cut in half, but this most undervalued asset is about to Surge.” the billionaire investor said. “Gold is one of the most undervalued assets available and it’s worth multiples of its current price due to the financial debasement of money by all the worlds central banks.”

Former Templeton Value Fund Manager and Founder of Mobius Capital Partners, billionaire Mark Mobius, thinks you should buy gold to prepare for global currency devaluation. The reason? The global frenzy of economic stimulus (central bank money printing).

“Currency devaluation globally is going to be quite significant next year given the incredible amount of money supply that has been printed.” he said.

Legendary investor Jim Rodgers of Quantum Fund and Soros Fund Management says, “Both gold and silver are going to skyrocket. History shows that whenever people lose confidence in governments and money, people buy gold and silver.”

And billionaire Leon Cooperman, the founder of hedge fund Omega Advisors, says if you’re looking for a store-of-value (SOV) asset in an uncertain economy, don’t buy cryptocurrencies that could become worthless, go with gold.

Billionaire investors believe the big upside in the decade ahead is in gold. And for good reason.

The unprecedented increase in the U.S. and Global money supply, means the value of paper money including the U.S. dollar has nowhere to go but down. And the gold price has no direction but to move higher.

Already, gold has maintained it’s value over time better than any other asset on earth. Since 2001, it has increased by 600%. An average return of nearly 30% per year. Yet, gold is still the most undervalued, and under owned investment asset in America.

Financial planners have long recommended portfolio diversification. And that a minimum of 10% to 20% of assets be allocated to gold and silver as financial insurance. Providing proven protection from asset bubbles, stock market declines, global economic crisis and currency debasement. (inflation)

Today more than ever, asset allocation and risk management is critical to building wealth and protecting retirement-savings.

Asset allocation is how you balance your wealth among broad asset classes like stocks, bonds, cash, real estate, and gold.

Keeping your wealth diversified across a mix of investable assets is the key to avoiding losses.

Risk management gets more important the closer you get to retirement. When Safety becomes the most important priority with IRA/401k savings.

Having your money properly allocated in the correct assets during different economic cycles is the key to financial success.

Here’s a breakdown of the recent decades with their preferred assets.

- During the 1990s, the stock market was the place to be. An explosion in Internet stocks led to the dot.com bubble. The Nasdaq rallied from 330 in 1990 to 5100 by 2000.

- During the 2,000s, precious metals and commodities were the best performing assets. Gold rallied from a low of $255 in 2001 to $1,923 by 2011.

- During the 2010s, money flows switched back to the stock market. The DOW bottomed at 6,469 in 2009, and prices topped at 29,600 in February 2020.

- The 2020’s favor tangible assets with supply shortages and currency debasement fueling soaring demand.

How you prepare now for the inflationary decade of the 2020’s will be the single most important factor in your financial security over the next 10 years.

The top rated Investment Advisory, the Aden Forecast (ranked #1 by Forbes) Now recommends having 70% of assets allocated to Tangible Investments like gold & silver. And just 10% in risk assets like stocks. “The stock market is very expensive and extremely overbought indicating the bull market is near maturity. Gold is cheap and clearly undervalued. It’s time for the precious metals to shine in the coming years.”

Gold has been the foundation of wealth and a monetary base for centuries. It’s the perfect way to protect yourself against inflation and overpriced stock market.

Repositioning IRA/401K retirement-savings out of risk assets (stocks, bonds) and dollar-denominated accounts (money markets, CD’s, annuities) into gold now, could be the best financial decision you make.

Gold offers unparalleled profit potential, a proven track record of appreciation, privacy and wealth preservation.

Investors today have an extraordinary opportunity to protect and grow IRA/ 401K assets with physical gold, and double their retirement-savings value by 2023, with a guarantee.

Click Here for Our Guaranteed Gold Account

Liberty Financial has helped thousands of Americans secure their financial future with tangible Investments, that provide a safe and predictable way to build wealth & protect retirement-savings.

Our commitment to excellence, award-winning advice and unmatched customer service, has earned us a top consumer investment rating. Making us the wise choice for tangible investments. Call now and discover how to…

- Protect your wealth against inflation and an overpriced stock market.

- Receive up to 20% more gold at no extra cost.

- Use the dollar devaluation to make once-in-a-generation profits.

- Invest with no-risk in our exclusive guaranteed gold account.

- Start a wealth creation and asset protection plan.