November, 2020 | True Wealth | The Secret Currency

How to make 500% from the U.S. government’s second, secret currency

There’s a “secret” investment behind some of the world’s richest families… one that few Americans know anything about.

It’s beyond the reach of any government or corporation. And it’s capable of producing amazing results… In the past, this investment has delivered returns of 500% to 1,000%.

We call it the “secret currency.” And today, I’m going to show you how to take advantage of it personally.

The secret currency is a form of gold and silver. But it’s not your typical precious metals investment.

- It has nothing to do with mining stocks, mutual funds, options, futures, or bullion. Instead, it’s a kind of currency used for centuries by many of the world’s richest families. But it’s not old-fashioned or obsolete. Dozens of wealthy families are still using this investment to both grow and safeguard their wealth. For example…

- The Rothschilds (at one time, the wealthiest family in the world)

- The Onassis family (Greek shipping magnate Aristotle married Jackie Kennedy after JFK died)

- The Hunt family of Texas (H.L. Hunt made his billions as an oil wildcatter) The DuPonts (whose descendants today run the second-biggest chemical company in the United States)

- The Morgans (J.P. was one of the richest railroad men of the last 100 years) The Adams family (famous for producing two U.S. presidents)

- The Hopkins family (Johns gave money to build the university and the world-famous hospital, which both bear his name in Baltimore)

- The Green family (Hetty Green was Hetty Green was once the wealthiest person in the world – wealthier than Bill Gates today)

- The royal Farouk family (which produced the last two kings of Egypt)

This investment is like regular gold and silver, only better – with the potential for much higher returns.

From 1972 to 1974, this investment rose 348%, according to an index that keeps track of its market as a whole. At the same time, stocks dropped 34%, according to the S&P 500 Index.

From 1976 to 1980, while the S&P 500 plummeted 35%, this investment realized 1,195% profits.

More recently, between 1987 and 1989, investors who took advantage of the secret currency saw profits of 665%. Stocks, meanwhile, went on a roller coaster ride – up and down dozens of times (sound familiar?) during this period.

The last time the Salomon Brothers brokerage firm included this vehicle in its annual investment survey, the secret currency ranked No. 1 over the prior 20-year span, with an annual return of 17.3%. In other words, it was the single most profitable thing you could do with your money over those 20 years.

It beat stocks, bonds, ordinary gold and silver, artwork, diamonds, U.S. Treasury bills, real estate, and oil, according to an article in the Chicago Tribune.

If you’re like most people, you’ve probably never heard of this secret currency before. And no one else – including your broker – is likely to tell you about it. Why should they? They don’t stand to earn a dime from telling you to invest in it.

But if this investment is good enough for the world’s wealthiest families – the Rothschilds, DuPonts, Morgans, Adamses, Hunts, etc. – it’s good enough for you and me. I want to show you how to make as much money as these folks have made – at least on a percentage basis.

I believe you could more than double your money with this investment. The last time the conditions were even close to this good (in 1987), investors made 665% profits on one type of this secret currency.

These kinds of gains are possible all because of a glitch in the system, created by the U.S. government. I’ll get into all the details in a bit, but first let me explain why gold and silver are the safest places for your money now…

What We’re Certain of… It’s a No-Brainer

For me, the starting point is always the same… What is certain? What is known? What can we bank on? And is there an outstanding way to profit that nobody has already gobbled up?

One thing we’re certain of right now is that the Fed is going to do its best to prevent deflation (falling prices). The Fed has repeatedly stated it will print money – as much as necessary – to head that off. In an effort to calm any fears, the government has been as explicit as possible that it would rather overshoot in this process.

The obvious result is more paper dollars out there. And the next result is that a paper dollar is worthless. Consider this scenario… Say the supply of gold stays roughly the same. But say the supply of dollars in the market increases dramatically. What should happen? It should cost more paper dollars to buy an ounce of gold.

And that is exactly what’s been happening.

The gold priced bottom below $1,200 an ounce in mid 2018 it’s been soaring ever since, and it hit a new all-time high of more than $2,000 an ounce in mid 2020. The same is true for silver it more than doubled from its 2020 low through its 2020 high.

Chances are, the Fed will be “fighting” this battle for a while. And therefore, chances are, gold and silver will be an excellent place to profit from this fight in the years to come.

So I went looking for the best way to get into gold and silver right now… the way that will give us significant upside potential, but will keep our downside risk limited. It’s actually hard to find…

We could own these precious metals outright. But if we’re right in this Fed scenario, we’d like a little more bang for our buck. We could buy gold and silver futures, but they’re risky – why risk losing more than our initial investment if we don’t have to?

The next logical choice might be buying shares of mining companies like Newmont, but mining stocks are risky, too. I had to dig deeper.

The secret currency is the super-safe way to get into gold and silver and still have big upside potential…

The Secret Currency of U.S. Gold Coins

This is an investment the most powerful and wealthy families in the world have used for generations.

But it’s not just any coins, it’s a very specific group of gold coins…

From 1795 until 1933 the U.S. used gold & silver coins as its currency. However, during the Great Depression of 1933 President Franklin Roosevelt made gold ownership illegal for U.S. citizens. The ensuing confiscation and meltdown of our nation’s gold currency by the U.S. Treasury Department has resulted in creating a unique gold investment vehicle that has out-performed all other investment assets. In fact, this secured gold investment has been the safest and most profitable way to invest in gold allowing ordinary investors the opportunity to make hundreds of percent gains as gold prices rise.

A pre-1933 Double Eagle $20 gold piece would have an intrinsic value of just a little less than the price of an ounce of gold, simply because it contains nearly an ounce of gold.

Of course, coin enthusiasts will always pay more than meltdown value for Double Eagle $20 gold pieces – as they are considered to be the most beautiful coins in the world. A 1933 Saint-Gaudens $20 Double Eagle sold for $7,590,000, the highest price ever paid for a coin.

But right now, we can own a piece of history, and we can own real money with real gold, for a small premium over the meltdown value.

The Benefits of Buying U.S. Gold Coins

First, these coins represent an “island of safety” from currency fluctuations. Their intrinsic value and desirability are not dependent on what’s going on with the dollar, the euro, or any other individual currencies. They’re also salable in almost any place on Earth in a wide range of currencies, as opposed to many traditional assets that are denominated in dollars.

A second benefit is anonymity. Rare coins are a way to hold some of your wealth without showing up on Forbes’ list of the wealthiest Americans. Things like real estate, stocks, and bonds can be easily tracked. On the other hand, owning rare coins is a way of taking your wealth out of view of almost anyone who wants to know what you own.

Third, unlike most other investments, rare coins are things that you can actually enjoy. You can buy a rare coin, hold it in your hand, and enjoy the history of it.

Finally, rare coins are an anti-confiscation hedge. The last time gold ownership was illegal in the United States (1933-1975), holding rare gold and silver coins was not illegal. Even FDR, with all his power at the height of the Depression, did not make rare coin ownership illegal.

What Kind of Upside Potential Are We Talking About?

“With modest investment in the right coins in the early 1970s you could cash out and buy a house by 1980, and many did.” – David Hall, founder, Collectors Universe.

Rare coins have experienced a few roaring bull markets since gold ownership became legal again. Coin prices (as measured by the CU 3000 Index) were up 1,195% in the 1976-1980 bull market in coins. In other words, a $10,000 investment would have risen to $129,500 in value.

In the 1987-1989 bull market, coin prices (as measured by the CU 3000 Index) rose by 665%. Coins like the Saint-Gaudens in pristine “Mint State” condition – coins graded “MS65” by the Professional Coin Grading Service (“PCGS”) – were big winners.

Our Investment Prospects.

In short I believe the upside potential in these coins is astounding. The story is simple. Today’s premiums are the lowest in history. Less than half of the premiums we saw in the 1990s and early 2000s. With prices so low you should definitely have these coins in your portfolio.

Our upside potential is unlimited – and historically, classic American coins have soared in Gold bull markets. As the dollar continues to lose value, the gold price will rise dramatically. That means the value of the investment gold coins could Skyrocket.

We have enormous upside potential. Triple-digit returns are possible in U.S. gold and silver coins now.

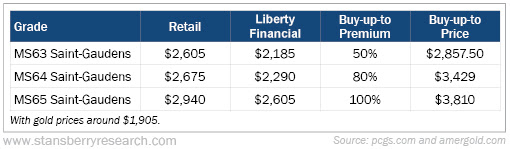

I’m willing to pay a 50% premium above the price of gold for Double Eagles, in MS63s. 80% above the price of gold for MS64s, and a 100% premium above the price of gold for the MS65s.

Here’s our simplified table to keep everything easy to follow:

Fantastic Secret Currency Deal… in Silver

990% in four years…

That’s how much silver dollars soared in the coin bull market from 1976 to 1980, according to David Hall in his 1987 book A Mercenary’s Guide to the Rare Coin Market.

The thing is, these weren’t any old silver dollars. These were silver dollars in MS65 grade… These were “secret currency” coins.

The market for silver dollars in MS65 corrected from 1980 to 1982. These coins soared again from 1982 to 1985 – rising 188.6%.

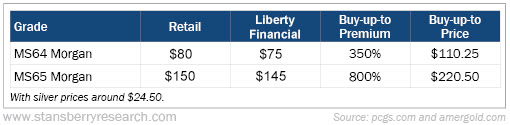

The Morgan dollar is without question the world’s most popular coin.

In 1986-1987, dealer cost – on these particular coins was near $1,000 per coin. That was more than three decades ago!

Meanwhile, the price of silver is up dramatically from where it was in the late 1980s.

In short, I believe the upside potential on these coins is astounding.

The story is simple: The price of silver has soared. But the price of Morgan silver dollars in MS65 grade has barely budged.

Since 2004, the price of silver has more than doubled. But MS65 Morgan silver dollars are roughly flat since then. That makes today’s premium one of the lowest in history.

Today, premiums to the price of silver are less than half of what they demanded during most of the 1990s and early 2000s when no one was interested in precious metals.

And the story is similar for lower-graded MS64 Morgan dollars. Their premiums are roughly half of the premiums we saw in the 1990s and early 2000s.

The premium on these coins has fallen to record lows in recent years, and it’s only now starting to recover. Relative to the current price of silver, the Morgan silver dollars I’ve listed in the table above are an excellent value, and they will make for great buys when they trade within our price range.

The Present Situation Is Like the 1970s

Back in the 1970s, the “real” return on cash (the return after inflation) was negative. So money flowed out of cash and into gold. Today, for the first time since the late 1970s, we’re seeing the same thing. The “real” return on cash is negative. It’s gold time.

Gold and silver coins are an excellent value right now… but not just any coins. The “secret currency” ones – I believe have the lowest downside risk and the most upside potential.

Your best bets are the Double Eagle gold coins and Morgan silver dollars – both in MS64 or MS65 grade.

Make sure you take advantage of today’s incredibly low premiums… Don’t miss out!

Steve Sjuggerud

Liberty Financial has the best prices for certified U.S. gold and silver coins. Up to 30% lower than most national dealers. Call 800-723-8349 or order online by clicking the links below.

Reserve Secret Currency U S. Gold Coins

Reserve Secret Currency U S. Silver Coins