January 2021

In 2020 we saw an unprecedented year of uncertainty due to the global pandemic that created political, social & economic instability not seen in generations.

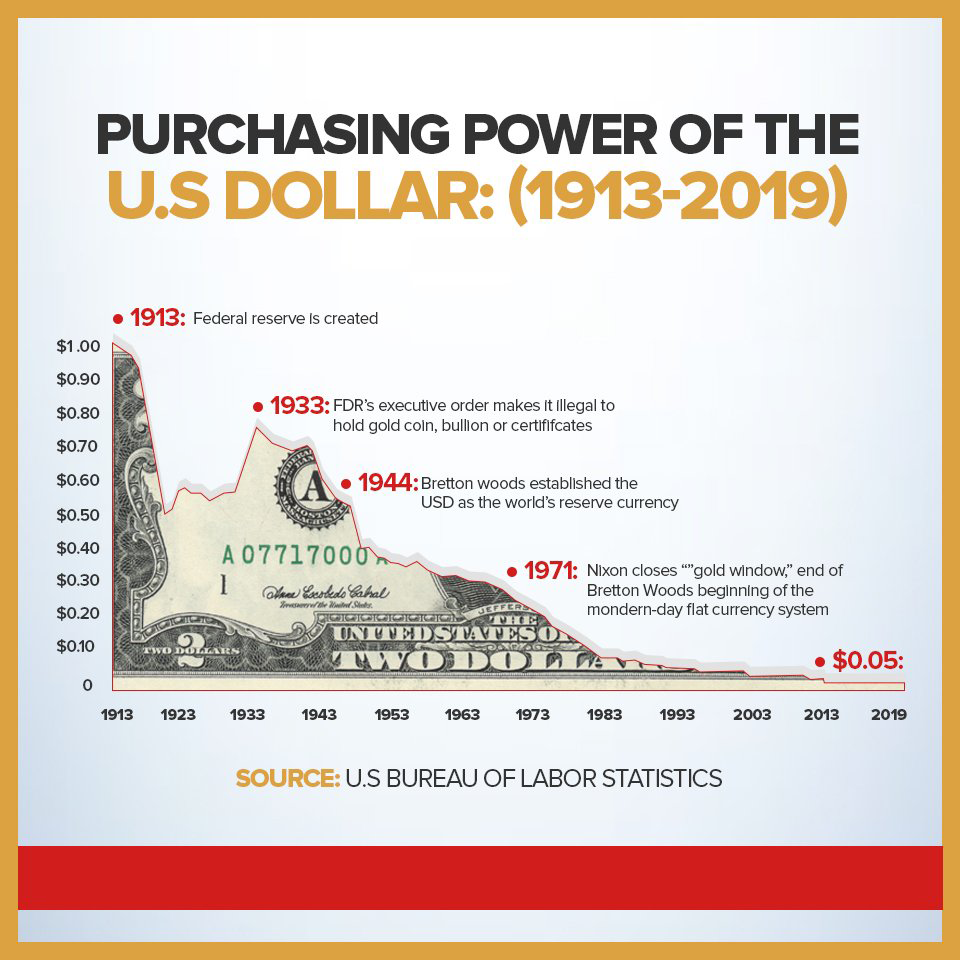

As a result, the global economy is in a recession. Central banks around the world are printing trillions in fiat currency. Debt levels are soaring. Never before has the Federal Reserve printed such massive amounts of dollars.

In today’s uncertain political and economic environment, it is wise to seek out proven assets in order to preserve and increase one’s wealth.

Gold’s traditional role as portfolio insurance against economic turmoil & currency devaluation has never been more necessary.

For 5,000 years gold and silver have been the ultimate form of financial insurance. Protecting wealth during economic crisis and market corrections & growing wealth by outperforming stocks, bonds, real estate and every other investment asset.

Gold has again been a shining light for investors in 2020. After rising nearly 19% in 2019, the metal gained more than 20% making it the best-performing financial asset.

And 2021 promises to be just as strong. The fundamentals that propelled gold to all-time highs – soaring debt ratios in major economies, unprecedented monetary easing and fiscal stimulus–will continue to increase next year and beyond.

Exploding debt and deficits

In 2020, Central banks including the Federal Reserve, printed an unprecedented $12 trillion in stimulus money ( fiat currency ) to support individuals and businesses due to the pandemic.

Nearly a quarter of all dollars in existence were printed by the Federal Reserve just last year.

We will have added 6 trillion to our national debt in the last 2 years. It took 212 years, from 1792 to 2004, for the debt to reach the first $6 trillion. Now the government is poised to add another $6 trillion in just 24 months.

That’s the greatest money supply increase in U.S. history.

The U.S. budget deficit hit an all-time high $3.1 trillion in 2020, double the previous record set during the financial crisis in 2008. Driven by $3.5 trillion in COVID stimulus. The highest GDP level since 1945, when the US was borrowing heavily for World War II.

Another coronavirus relief package of just under $1 trillion, along with a new $1.9 trillion will add another 3 trillion dollars, pushing our total national debt to well over $30 trillion.

Since 2009 our national debt has exploded, hyper-inflating the stock and bond markets, and creating the largest financial bubble in history.

As U.S. stimulus continues at its torrid pace, U.S. dollar depreciation will drive gold prices exponentially higher. Prices of tangible assets – ones that the Fed can’t print – will soar in value.

Invest in Gold today – don’t wait for the market to crash 📉

Since 1929 there have been 20 major stock market crashes about one every five years with an average fall of 36%.

In each case gold has held its value or appreciate it greatly.

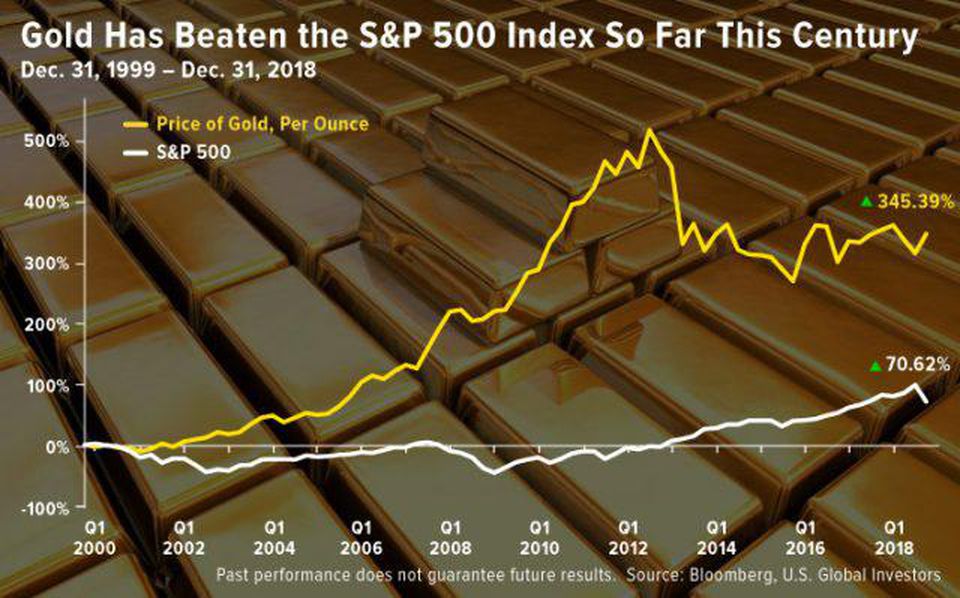

Gold nearly triples S&P 500 return since year 2000 💵 $10,000 invested in gold would now be worth about $68,000 versus $23,000 in stocks.

It’s a dangerous time to be an investor in an environment when risk assets ( stocks & bonds ) are propped up by monetary and fiscal stimulus, and not by sound economic fundamentals. The stock market and the bond market hyper-bubble are 100% dependent on Federal Reserve money printing.

The benchmark S&P 500 Index recorded it’s highest price-to-earnings (“P/E”) ratio over the past 30 years. Stocks are 50% more expensive now, than at the beginning of 2020.

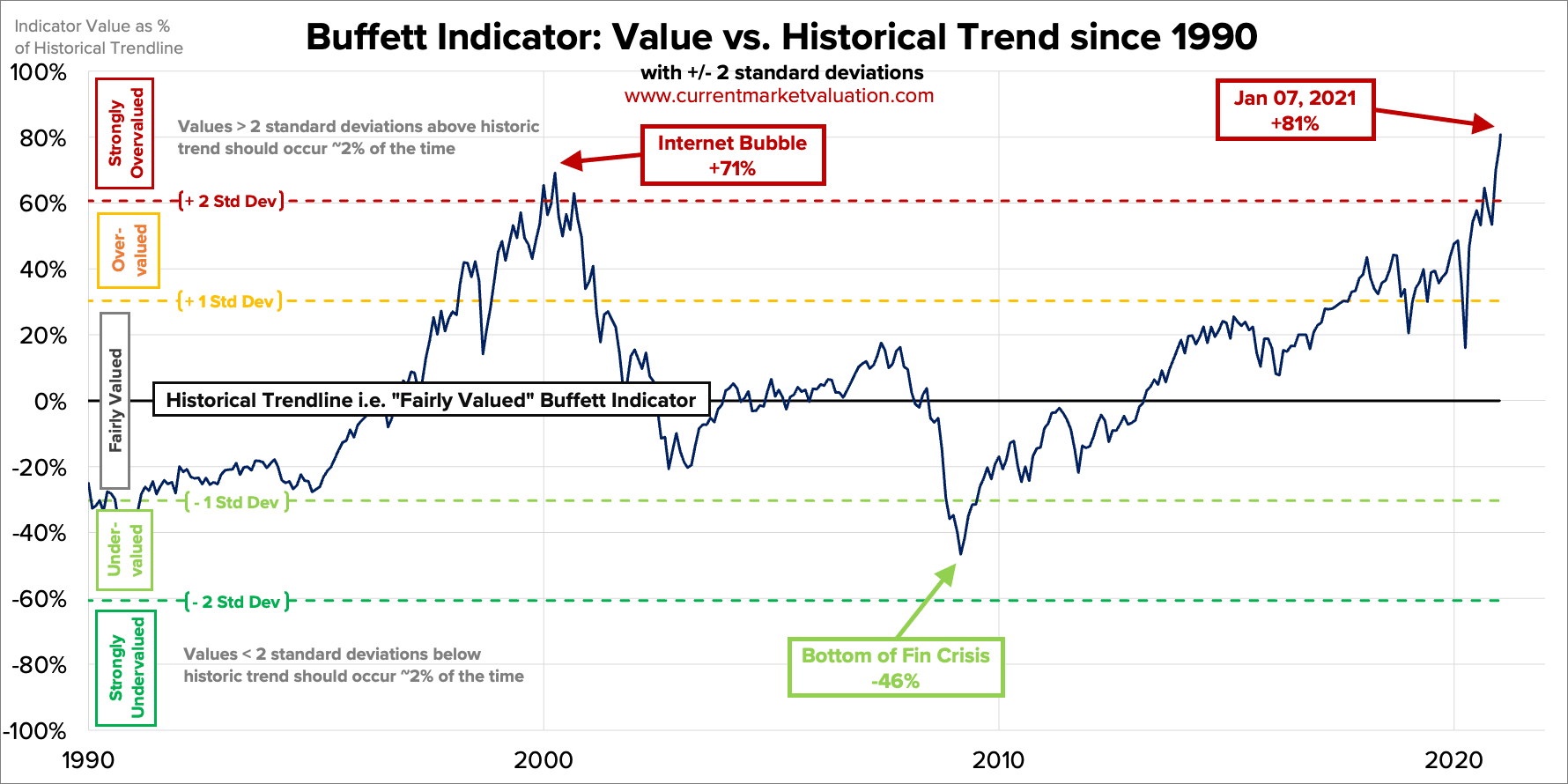

January 2021 Warren Buffet’s reliable valuation indicator (U.S. stock market valuation to GDP) shows stocks are extremely overpriced.

Buffett Indicator: 220%

Currently 81% higher than the historical average, showing that the market is Strongly Overvalued. It has not been at this level since the Internet Bubble of the early 2000’s. Leading Warren Buffet to buy $500 million of gold for the first time ever.

Financial advisors and economists have long recommended portfolio diversification, and that 20% of investors assets be devoted to gold and silver as portfolio Insurance. Providing proven protection from equity investment losses, asset bubbles, global economic crisis and currency debasement (inflation)

Unlike paper Investments (stocks, bonds and currencies) that can become worthless overnight. Gold and silver have true intrinsic value. They cannot be debased by governments that print paper money at will making their currency worth less each year.

Never forget that anything denominated in dollars (stocks, bonds, CDs, annuities) loses value with each passing month.

In 2021 the stock market may be cut in half and your money in the Bank will lose much of its purchasing power. But, gold has been the most reliable & sought-after form of asset protection and wealth creation for thousands of years.

Overvalued Equity markets, and a monetary system overcome with indebtedness, is not a safe place to entrust your financial future. Fed induced equity gains won’t last forever. Eventually, every bubble bursts.

Don’t be caught holding worthless stocks or depreciating currency.

We are near the end of the longest stock bull market in U.S. history, that began in 2009. And the beginning of the next great tangible asset boom.

That’s why smart investors are preparing now to profit from the next stock market crash by diversifying their retirement savings out of the unstable equity markets, into the safety of gold and silver for long-term appreciation and stability.

Classic American gold and silver coins provide unparalleled profit potential, a proven track record of appreciation, privacy and wealth preservation.

For conservative investors who want physical gold and silver that is completely private and has stronger upside potential than bullion, U.S. gold and silver coins are comparably priced with modern bullion coins, yet offer historical and numismatic value that bullion cannot match.

Our exclusive gold Guarantee gives you the opportunity to buy physical gold and silver with No risk. Because, we guarantee to buy back your gold or silver coins for at least the full purchase price you pay or higher, anytime after 24 months. Which means your gold investment can only maintain or increase in value. Giving you the best of both worlds… unlimited profit potential and complete safety of principal.

Since 1982 Liberty financial & affiliates have been the trusted name in wealth management, with over 1 billion in customer transactions. We have helped thousands of Americans protect and grow their assets with tangible Investments.

Our commitment to our clients success, award-winning advice and unmatched customer service, has earned us a top consumer investment rating & assures each investor of a positive, risk free transaction every time.

Never before has there been a better time to safely grow your wealth and protect your retirement savings from the ongoing dollar devaluation.

This is your chance to reposition retirement savings out of the unpredictable stock and bond markets, into the security of tangible assets.

With Guaranteed silver portfolios starting at just $5,000 and gold at $10,000, we urge you to invest today, before prices rise again. It could be the most profitable decision you make.