Stefan Gleason

February 2022

The U.S. just reached a $30 trillion milestone.. Instead of signifying a great achievement, though, it serves as a dire warning for American workers, investors, and retirees.

On February 1st, the Treasury Department reported that total public debt outstanding surpassed $30,000,000,000,000.

Since 2009, the National debt has exploded, more than tripling from $8 to $30 trillion dollars, hyper inflating the stock, bond and real estate market & created the largest financial bubble in history.

Interest on the debt currently costs taxpayers $900 million per day, or $330 billion per year. Enormous as that sum may seem, it is artificially low at present due to depressed interest rates.

Despite talk of hiking later this year, the Federal Reserve continues to hold short-term rates near zero. It has also been actively intervening in the bond market to help keep a lid on longer-term bonds issued by Uncle Sam.

Were rates to normalize relative to inflation (which is running at 7% per the latest Consumer Price Index reading) debt servicing costs would become a full-fledged budgetary crisis. Without drastic cuts to outlays and/or increases in revenues, federal finances would enter a terminal death spiral.

One way or another, the coming debt crisis will morph into a currency crisis because “Free Money” from the Fed has a cost, of course. And that cost will be borne by holders of U.S. dollars and dollar-denominated IOUs who see their purchasing power steadily obliterated.

Wise investors can see the writing on the wall. They are taking steps to protect themselves now from the great currency debasement ahead.

The only “cash” with a proven track record of conserving purchasing power over time is real money – gold & silver. They cannot be debased by governments who print paper money at will, making their currency worth less every year.”

Never forget, anything denominated in dollars (stocks, bonds, CD’s, mutual funds) loses purchasing power with each passing day.

In fact, since 1972 gold has increased 58 times in value, while the U.S. dollar has lost 90% of its purchasing power.

Gold & silver provide essential ‘Financial Insurance’ that protects savings against equity market declines, asset bubbles, global unrest and currency debasement (inflation.)

In 2022 the stock market may get cut in half and money in the bank will lose much of its value. ( inflation ) But, gold & silver will continue to protect and grow wealth as it has for 5,000 years.

$30 Trillion Debt Will Cause Stampede to Safe-Haven Gold

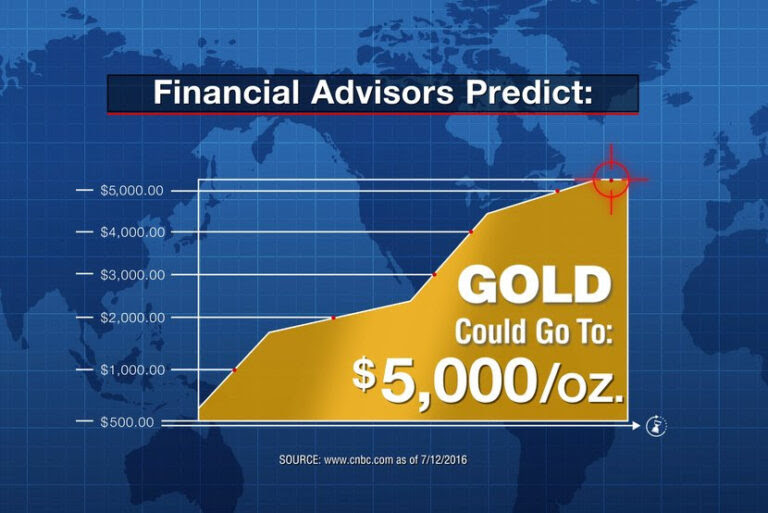

Gold is the perfect way to inflation-proof savings. Many renowned experts expect gold prices to soar to $5,000/oz due to U.S. dollar debasement.

During a currency crisis or 1970’s-style stagflation cycle, a rush to safe havens can produce spectacular bull market gains in gold & silver over and above inflation.

The 1970’s saw gold increase 20 times in value. And the last time conditions were even close to this good (2008) gold tripled in price and silver soared 500%, turning $200k into $1 million dollars in just 2.5 years.

Today you can use the dollar devaluation to make once-in-a-generation profits, and safely grow your retirement savings with no-risk, in U.S. Government issued gold.

Better than Bullion.

For conservative investors who want physical gold that is completely private and offers stronger upside potential than bullion. Classic American gold & silver coins are comparably priced with modern bullion coins, yet have historical and numismatic value that bullion cannot match. They offer the best combination of low price, low premium, fundamental scarcity, and strong track record of leverage to the bullion price.

U.S. Double Eagle Liberty gold coins minted from 1877- 1907 combine true scarcity, high gold content with historic low prices and premiums to create an extraordinary investment opportunity.

U.S. Double Eagle Liberty gold coins minted from 1877- 1907 combine true scarcity, high gold content with historic low prices and premiums to create an extraordinary investment opportunity.

MS63 $20 Liberty’s offer a superior track record of profitability over bullion. For about the same price as a common 1-ounce Gold Eagle, you can get a 100 year old U.S. gold coin that has traded at 3 times its intrinsic gold value, in the last 15 years.

During the height of the financial crisis in 2009, these $20 Liberty’s traded at $3,100 with gold bullion at $925. That’s $5,565 at today’s gold price.

When the premium reverts again, MS63 $20 Liberty’s would gain $3,270 from today’s low price of $2,295. Almost double the current market value, with no change in the underlying gold price!

The premium for Choice $20 Double Eagle’s (cost over intrinsic gold value) is only 20% today. This has created an unprecedented investment opportunity to own historic U.S. gold at bullion prices, and see triple digit gains in the coming months.

In fact, the last two bull markets in U.S. coins saw prices rise 665% and 1,095% (PCGS 3,000 Index.)

We have secured a small number of these classic American rarities, at the lowest price in the nation, with dates that are up to 5 times rarer than the most common dates, offering powerful investment leverage at no extra cost.

These historic coins are currently valued at $2,395. But while they last, we are making them available at dealer pricing of only $2,295 each, a $100 savings! ( limit of 5 coins per customer.)

Each coin has been certified by PCGS or NGC. And comes with our exclusive guarantee. Providing unlimited profit potential with no risk.

$20 Liberty’s offer precisely the kind of “double play” leverage we look for in classic U.S. gold coins: the proven ability to rise by much more than their underlying gold price because of fundamental scarcity and restricted supply in the national market.

Even a modest rise in demand can overwhelm existing market supplies, driving prices much higher, often very quickly.

So, don’t miss the last great buying opportunity, in the worlds cheapest asset.

Key Benefits:

- Low premiums. Comparably priced with modern bullion coins yet, significantly rarer.

- Proven crisis track record. Premiums tripled during the last financial crisis in 2009.

- Exceptional scarcity. Only small number of survivors certified in mint state condition (PCGS & NGC) which means prices can rise sharply in gold bull market.

$2,295 per coin – $100 Discount. Limit of 5 coins. Call now to reserve historic U.S. gold at bullion prices, before our limited quantity sells out & values rise again. It could be the most profitable call you make in 2022. (800) 723-8349

Since 1982, Liberty Financial has helped thousands of American’s secure their financial future with tangible investments. Our low prices, expert advice and exclusive guarantee has earned us a top consumer rating, and made us one of the top wealth management companies in the nation.

You can invest with confidence. Our guarantee of satisfaction assures each customer of a positive, risk free transaction every time.

Trusted Advice. Proven Results. Guaranteed Security.

Trusted Advice. Proven Results. Guaranteed Security.