April 2022

Stagflation is coming to America. – Economist Peter Schiff.

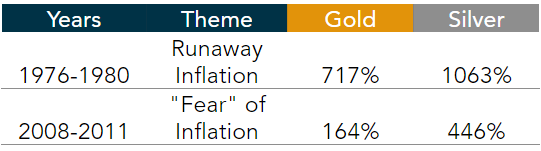

Stagflation in the U.S. was a decade defined as an extended period of poor real returns, says Goldman Sachs. While stocks languished during the stagflationary 1970’s, with negative returns, gold went on a tear rising 1,836%. Silver rose 1,689%.

“The inflation is going to be much worse than the 1970’s. The economy is going to be much weaker. And unfortunately, we won’t be able to put a stop to it like we did in 1980. We have no ability to raise interest rates because the country is completely insolvent. Even a small increase would cause a default.” – Peter Schiff.

Billionaire Ray Dalio, founder of the world’s largest hedge fund, Bridgewater & Associates, has warned that the U.S. economy is headed for ‘stagflation’ similar to that of the 1970s.

Dalio said that the explosion in the money supply was to blame for devaluing currency even as it boosted stock markets.

‘When you spend a lot more money than you earn, then you have to print money, to make up that difference,’ he said.

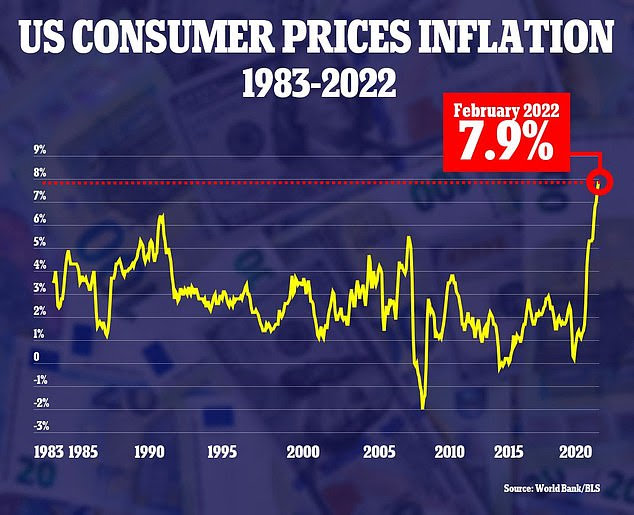

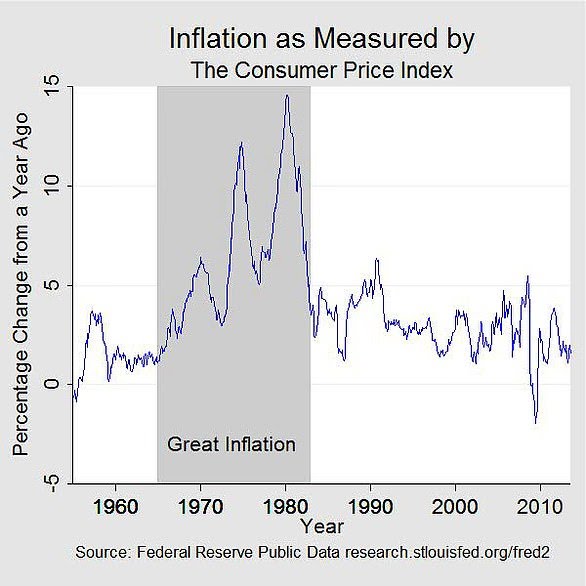

The ‘Great Inflation’ period from 1965 to 1982 was marked by soaring inflation that topped 14 percent by 1980.

Bank of America warned that “inflation always precedes recessions” and that price pressures already out of control. Tighter monetary policies being put in place to control surging prices make a “recession shock” very likely. Late-60″s recession preceded by consumer price inflation, 1973/4 by oil/food shocks, recession of 1980 by oil, 1990/91 by CPI, 2001 by tech bubble, 2008 by housing bubble; last dominos to drop in terms of recession expectations is higher yields & weaker dollar, and yield curves always steepen as recessions begin,” the report read.

BofA has joined a chorus of financial institutions warning about the likelihood of an immediate recession.

We currently have the highest price inflation in 40 years, over 10% in most places.

We also have the elements for even higher inflation. Washington’s new budget proposal is the biggest in history, an astonishing $5.8 trillion dollars 🏦

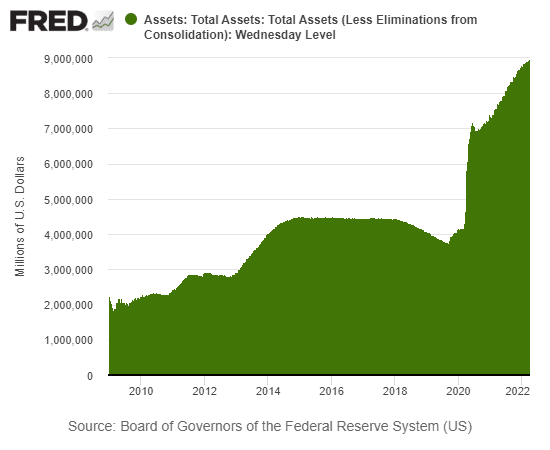

Perhaps most shocking of all is that, despite what Fed Chairman Jerome Powell has said about tackling inflation, the Federal Reserve continues to print more money.

Since November, when the Fed finally pledged to reign in its money printing, Fed assets – its purchases of financial assets with digitally-printed, made-up money – have continued to grow at a 10% annual rate. You can see this money explosion in the following chart.

Printing more money isn’t the way of getting serious about inflation.

As prices have climbed throughout the economy, the Federal Reserve has begun to hike interest rates. But, that has triggered a yield curve inversion which has precluded sharp economic downturns and every recession in U.S. history.

Rising rates has also stuck bondholders with big losses, threatens to burst the stock market and real estate bubble, and force businesses to curtail spending. The Fed may have to pause tightening and even reverse course on future rate increases, allowing inflation to rise, decimating dollar denominated investments. ( stocks, bonds, annuities, CD’s, etc )

This is happening because of a faulty monetary system that will continue to cause bubbles, mis-allocations of capital, and greater and greater loss of purchasing power.

Global Reset 💵

Russia’s invasion of Ukraine, unrelenting inflation, including soaring food and gas prices, and unpayable debt levels continue to relentlessly climb. And carry long-term economic consequences…

Ron Paul, the former congressman, presidential candidate, and gold authority, said this about the consequences of America’s intervention in the Ukraine Russian conflict: “[It] has caused more countries to seek alternatives to the dollar. This increases pressure for the dollar to lose its world reserve currency status. When that happens, the U.S. will face a major economic crisis featuring hyperinflation, massive unemployment, and the growth of authoritarian political movements.”

New World Order 🌎

The world’s monetary order based on U.S. Dollars as the global reserve currency are coming to an end. In waging a currency war on Russia, the U.S. has inadvertently accelerated the process of dethroning the U.S. dollar. Russia has made the Ruble the first currency tied to gold, and China, India and Saudi Arabia are all transitioning from dollars to their own currencies and gold as well.

Goldman Sachs released research on “de-dollarization” showing a major push that countries around the world are now moving away from the dollar, eroding its global dominance.

Opportunity 💴

This has created massive upside potential for gold & silver. War and inflation have fueled record safe haven buying in gold & silver. Because, they cannot be debased by governments who print paper money at will, making their currency worth less each year. Gold protects savings against equity market declines, asset bubbles, global economic crisis and currency debasement (inflation)

Periods of high inflation are extraordinary opportunity’s for gold and silver investors.

This is only the beginning of a cycle the likes of which we haven’t seen since the late 1970s, a time of historic gains for precious metals.

* Rick Rule, the Director of Sprott U.S. Holdings, believes gold prices could triple within the next five years. He noted that when gold and the U.S. dollar rally in tandem, stronger gold prices follow. Kitco reports, “Rule said that in past bull cycles, gold has climbed at least seven-fold and that it is very likely that gold will double or triple by five years’ time.”

* VanEck sees extreme scenario where gold is $31,000 | Russia’s war in Ukraine has created what some economists see as irrevocable shifts in the geopolitical landscape; Fund managers at VanEck looked at how this new landscape will impact financial markets and the makeup of reserve currencies as nations look to diversify their holdings out of dollars. the authors of the latest report, see significant upside for gold. said in their report. ” Precious metals are the original reserve asset.”

This is the first time in recent history that significant economic sanctions have been placed on a world power. “Something big has happened, and we are attempting to quantify its impact. The bottom line is that the upside for gold is potentially dramatic. Specifically, the framework estimates gold prices of around $31,000 per ounce. ( $387/oz. Silver )

VanEck developed its gold price scenarios by comparing current gold reserves with the global money supply: M0 and M2. The asset management firm reported.

* The #1 ranked Aden Forecast ( Forbes ) Reports that, “Unprecedented amounts of money printing by the Fed has never happened before in history, and gold has not yet reflected the effects of this unparalleled monetary policy. But it will, and when it does the price of both gold and silver will soar to unheard of levels.”

Structuring your portfolio for the rest of the 2020’s.

“Precious metals are and always have been the ultimate insurance,” says economist Robert Hartman. “They provide protection both against state failures and against mistakes in the monetary policy of the central banks. Every investor who looks into the history books sees that both have happened over and over again in the past centuries. From that perspective, investing in physical gold and silver is a common-sense precaution and a necessary part of any wealth preservation plan. Investors Investors and ordinary savers ignore this at their peril and the failure to include precious metals in one’s portfolio is pure negligence.”

Precious metals are a crucial component in any truly balanced investment portfolio regardless of economic conditions.

Far from being an arbitrary speculation, gold is considered to be a “Tier 1” asset in the global banking system. In a world of depreciating fiat currencies, gold is the ultimate money.

It is also the ultimate hedge against geopolitical turmoil and financial market meltdowns.

Overvalued equity markets, and a monetary system overcome with indebtedness, is not a safe place to entrust your financial future.

Never forget that anything denominated in dollars (stocks, bonds, CD’s) loses value with each passing month.

As gold values continue to rise against a falling dollar. Investors today have a historic opportunity, to use the dollar devaluation to make once in a generation profits, and safely grow their retirement savings with no-risk, in U.S. Government issued gold & silver…

Better than Bullion.

For conservative investors who want physical silver that is completely private and offers stronger upside potential than bullion. Classic American silver dollars ( 1878-1935) are comparably priced with modern bullion coins, yet have historical and numismatic value that bullion cannot match. They are the largest silver coin ever issued by the U.S. government and offer the best combination of low price, low premium, fundamental scarcity, and strong track record of leverage to the bullion price.

Investor Special – Historic U.S. Silver Dollars at Bullion prices.

For about the same price as a common 1-ounce silver American Eagle ( $39 ) you can get a rare 100 year old U.S. silver dollar, that is significantly rarer, and has traded as high as 200% over its intrinsic silver value.

Classic American silver dollars are in such high demand that collectors and investors eagerly pay $10’s of thousands of dollars for rare examples. And recently, a rare 1895 Morgan silver dollar sold for a record $269,500 at auction! Making these coins some of the most valuable and sought-after U S. rare coins in the market today.

Silver Dollars have produced phenomenal profits for investors during their rising cycles. In fact, during the last great bull market in U.S. coins. Gem quality silver dollars soared 900% in value. Rewarding investors with record profits, during a time when stocks, bonds and real estate were collapsing.

These vintage U.S. silver dollars are trading at record low premiums again, and represent a rare opportunity for triple-digit returns.

📈 We have secured a small number of original 100 year old U.S. silver dollars in brilliant uncirculated condition at the lowest price in the nation. These coins are currently valued at $47 each. But, while they last, are making them available at wholesale dealer pricing of just $39.95 a coin.

When premiums revert again, these American rarities could double in value. And when silver bullion returns to $49/oz, could soar 3 to 5 times from current levels.

Best of all, we guarantee to buy back these coins for at least the full purchase price or higher, which gives you unlimited profit potential, with no downside risk.

Silver is currently trading at half of its 1980 Peak price, making it the most undervalued commodity in the world today.

However, dwindling supplies and increased demand for physical gold & silver in 2022, is making undervalued coins like these extremely difficult to find. Even a modest rise in demand can overwhelm existing market supplies, driving prices much higher, often very quickly.

So, don’t miss out on the last great buying opportunity in the world’s cheapest asset.

Special Offer

$39.95 per coin – 15% Discount. Limit of 100 coins. Call now to reserve historic U.S. silver dollars at bullion prices, before our limited quantity sells out & values rise again. It could be the most profitable call you make in 2022. (800) 723-8349 ☎

* Golden Opportunity 💴 We also have secured an extremely small number of historic U.S. gold coins at bullion prices! ( click link for details/ better than bullion)

Since 1982, Liberty Financial has helped thousands of American’s secure their financial future with tangible investments. Our low prices, expert advice and exclusive guarantee has earned us a top consumer rating, and made us one of the top wealth management companies in the nation.

You can invest with confidence. Our guarantee of satisfaction assures each customer of a positive, risk free transaction every time.

Liberty Financial 🗽 Trusted Advice. Proven Results. Guaranteed Security.