Wednesday, October 7th, 2020

Massive Currency Debasement Begins 📉

Central banks around the world, including the Federal Reserve, have unleashed the greatest tsunami of money printing in the history of civilization, to combat the economic damage done by the global pandemic. This has hyper-inflated the stock and bond markets and created the largest financial bubble in American history, even worse than the dot-com or real estate bubble that took most stocks and bonds down along with it. Anyone holding dollars or dollar denominated assets must defend their wealth now, before the bubble bursts.

The rush to the exit has Already began.

The Chinese have stopped buying U.S. Treasuries which fund the U.S. government. Instead they have joined Russia and are putting their cash reserves into gold.

That’s why Yale economist Peter Schiff, who accurately predicted the 2008 financial crisis said. “Gold is the asset likely to replace the US dollar as the world’s Reserve currency”

Even Warren Buffet admitted publicly “The frantic spending and money creation underway right now will cause the U.S. to experience a currency destroying inflation that is going to be much more sever than in the 1970s.”

And for first time ever, his company Berkshire Hathaway, began buying Gold. Investing $500 Million, as it’s the only proven asset that protects money against stock market declines, equity investment losses, asset bubbles, global economic crisis and currency debasement.

Nobel Economic Prize winner Dr. Paul A. Samuelson, hardly an alarmist, recently said U.S. financial imbalances are so severe and irreversible that ”We must accept that at some future date there will be a run on the dollar”. Probably the kind of disorderly run that precipitates a global financial crisis.

That’s why billionaires such as Jim Rogers have used the temporary dollar rally of recent days, to evacuate their assets out of harms way – before, as he puts it the dollar “Goes the way of the pound sterling and declines by 90% in the coming years.”

FINANCIALLY THE U.S. IS ON A ROAD WITH NO TURNS

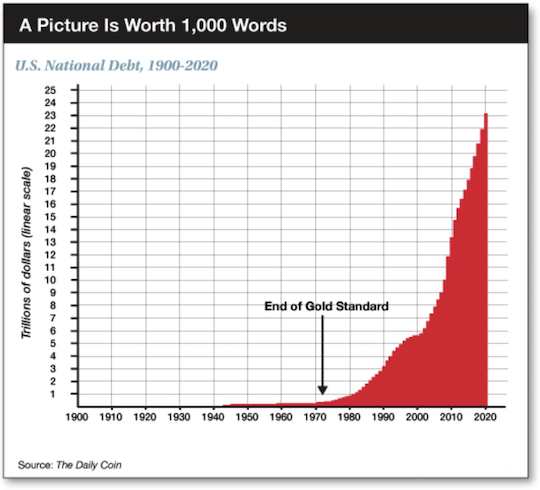

We are witnessing the beginning of the end of a 49 year experiment-in which global currencies linked to the dollar, with no gold/silver backing, are reaching the final inevitable stages of all fiat money. In short, the U.S. is printing its way out of debt. And that means the value of each and every dollar that you own is about to go down significantly. In fact, Financial experts and Economists expect the dollar to fall by 35% over the next 12 to 18 months. Which means unprepared investors could lose 1/3 of their retirement-savings.

The Fed an inflation denier, has chosen to use the age-old politically expedient solution of inflation and currency debasement to deal with the growing debt burden. However, history shows that all Fiat currencies have eventually been printed into Oblivion, with the average lifespan being 50 years. The U.S. abandoned the gold standard in 1971 ( Constitutionally illegal) America’s currency debasement and debt accumulation has sown the seeds of inflation,while eroding the dollar’s role as the world’s reserve currency.

The trade of the Decade. Buy gold/Sell stocks 📈

The DOW index itself has been collapsing against the value of hard assets for some time now. Stocks have lost 55% of their purchasing power vs real money (gold & silver ) since 2000.

January 2000

Dow 11,500

Gold $275

42 oz of gold to buy 1 share of the Dow.

January 2020

Dow 29,000

Gold $1,500

19 oz of Gold to buy 1 share of the Dow.

Even after the longest Stock bull market in American history. Stocks have lost a whopping 55% in real value! Wall Street can fool millions of investors on the short term, But they can’t fool those who measure their wealth in terms of precious metals, which retain their value over time.

There’s only way to survive with your money intact — and thrive by growing your wealth swiftly during the dollar decline…

Unlike paper investments that can become worthless overnight ( stocks, bonds, currencies ) Gold & silver have true intrinsic value. They cannot be debased by governments that print paper money at will, making their currency worth less each year.

Over the long-term, gold has outperformed stocks, bonds, real estate and every other investment class by a wide margin. During the last half-century the U.S. Dollar has lost 87% of its purchasing power, while gold has increased 58 times in value.

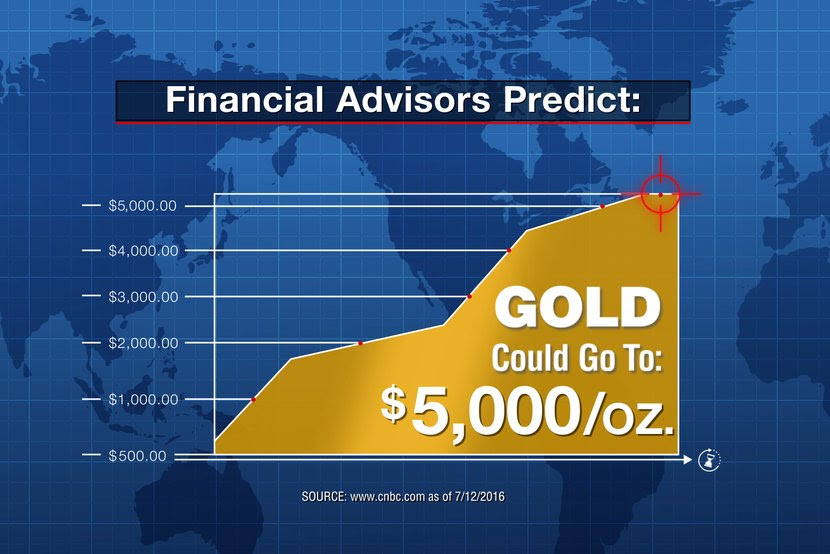

Gold is up 25% in 2020 and over 50% since it bottomed in 2018. But, according to Pierre Lassonde, founder of gold miner Franco-Nevada, still incredibly cheap. “You haven’t missed the boat at all, even though gold is up. We’re barely off the bottom at this point in time, and there’s a lot to go before we reach the top. Should the Dow Jones to gold ratio retrace to 1:1, which it has on several occasions in the past, the gold price could climb to $15,000 to $20,000 an ounce assuming the metal catches up to the Dow.”

Ray Dalio who manages the world’s largest hedge fund, Bridgewater and associates, noted that the recent fiscal and monetary stimulation of such magnitude is unprecedented during peacetime. “We’ve had a few such periods of extraordinary stimulus over the past century—all in times of economic depression, conflict, or both—and in all of them, gold saw triple-digit rallies that dwarf its recent run-up.”

Renowned Economist Peter Schiff warns, “Ultimately the world is going to sever its relationship with the dollar. It will go off the dollar standard and back on the gold standard. Twice in the prior century during significant bear market lows, the Dow traded down to a single ounce of gold. So, if you look at where the Dow is now at 26,000 and figure where would the price of gold have to be to equal the Dow at the current price, it would be $26,000.”

Historically the price of gold is equal to the number of dollars in circulation. This is the true value of the currency that the metal is priced in and the standard by which all paper money has purchasing power.

Washington Insider and #1 New York Times bestselling author, Jim Rickards projects $15,000 gold by 2025. “If you take the M1 money supply in dollars, euros, pounds, yen and yuan – and divide it by the official amount of gold, you get about $15,000 per ounce.

Gold is the only way investors can protect themselves from watching the buying power of their life savings being devalued. We urge investors & savers to be good stewards of the resources they’ve been entrusted with, and have 20% of investment assets in physical gold & silver. They provide Financial Insurance & protect your retirement- savings against equity market declines, asset bubbles, global economic crisis and currency debasement (inflation.)

Real Money Is the Ultimate Inflation Hedge

Gold is a timeless, immutable monetary asset, still widely held by central banks & partner silver are an Indispensable long-term hedges against inflation and political/financial turmoil.

Over a period of decades and even centuries, the purchasing power of gold and silver remains constant. They can post huge gains when conventional markets are falling – that’s what makes them essential for proper portfolio diversification.

WHY YOU MUST NOT FALL FOR THE ILLUSION OF “SECTOR DIVERSIFICATION”

Your broker and the Wall Street media tout the value of diversification. But diversification is limited to dollar denominated stocks and bonds. Never forget anything denominated in dollars loses its purchasing power with each passing month. Overvalued equity markets, and a monetary system overcome with indebtedness, is not a safe place to entrust your financial future. This is your chance to reposition your retirement-savings out of the unstable stock market, into the safety of gold & silver for profits and protection.

ACT TODAY AND PROSPER

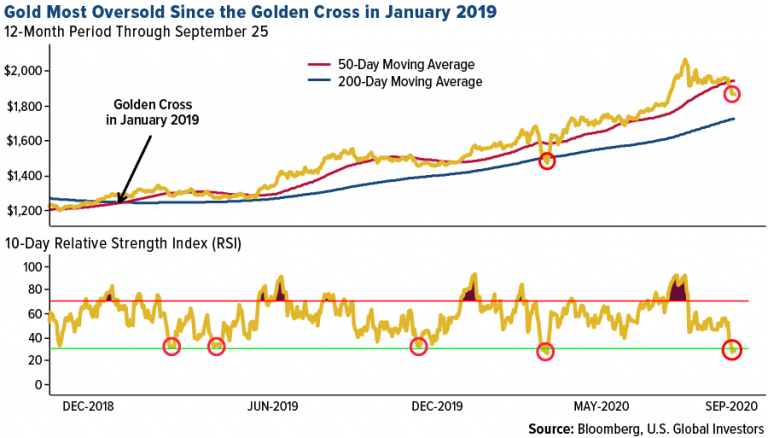

Buy the dip in gold, not stocks, says Citibank. Considering all the uncertainty around the election, Citi noted it could be “an extraordinary catalyst” for gold during the fourth quarter of 2020. “That is one reason why we expect gold prices to hit fresh records before year-end,” Citi said.

After soaring above $2,000 an ounce for the first time in history. Gold has pulled back and now is extremely oversold again, just like it was in March, before prices soared $300 an ounce. So, for those who missed out on the first upleg in gold prices. This temporary pullback offers an outstanding opportunity for investors to buy gold, before prices rise again.

Better than Bullion

For decades classic American gold coins have served as a discreet asset accumulation vehicle for some of the wealthiest families in America- like the Morgans ( J.P. Morgan) DuPont’s (DuPont Chemical) Heinz (Ketchup) Bushnell’s ( Bausch & Lomb) & Hunts (Oil). Not to mention several billionaires who wish to keep their privacy,

They offer unparalleled profit potential and a proven track record of appreciation.

Incredibly, classic American gold & silver coins minted by the U.S. government last century, are comparably priced with modern bullion coins, yet offer historical and numismatic value that bullion coins cannot match. In fact, there hasn’t been a time in recent history, when pre-1933 U S. Gold was selling at such a small premium above the spot price.

Unlike bullion, classic U.S. Gold coins have the explosive potential to deliver 2-to-1…5-to-1… even 10-to-1 returns on your initial investment. It’s the only physical gold investment that you hold in your hands, that offers powerful investment leverage like mining stocks, without the downside risk. And offers the best gold value.

These coins can and have soared 10-fold in previous bull markets. The last two bull market saw Pre- 1933 U.S. gold coins rise 665% and 1,095% ( PCGS – 3000 index) Today premiums are at historic lows. Offering outstanding profit potential for investors who act quickly. As even a modest rise in demand can overwhelm existing Market supplies driving prices much higher, often very quickly.

National supplies for these historic U.S. gold coins are the lowest we’ve seen since 2009. Fortunately, our long-standing position in the National Market has given us the most undervalued pre-1933 gold inventory in the nation. But, supplies are extremely limited and they sell out quickly. We urge you to get them now, before prices rise again. It could be the best decision financial decision you make.

Call (800) 723-8349 or order online at: LibertyFinancial.org

Since 1982, Liberty Financial has helped thousands of Americans convert their rapidly depreciating paper dollars into real money- Gold & Silver-for profits and protection. Wholesale prices, award-winning advice, unmatched customer service and our best value guarantee, has made us the #1 Investment company in America 🇺🇸