June 30, 2020

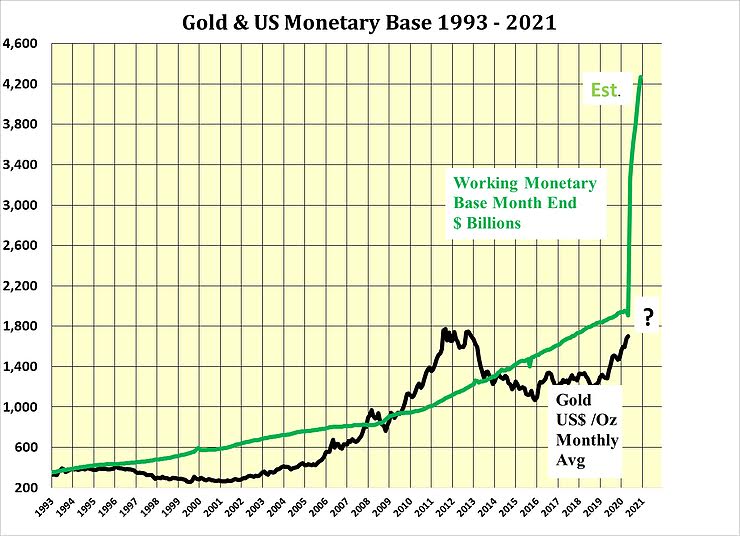

Bank of America shocked the financial world with a forecast that gold will rise to $3,000 an ounce within 18 months, a 76% increase from current levels and more than 56% higher than the safe-haven asset’s all-time record high of $1,921.17, set in 2011.And the reason? The U.S. Federal Reserve. The prediction came in a memo to investors called “The Fed Can’t Print Gold,” and it highlights the fact that interest rates are going to remain low in the U.S. and the rest of the world for the foreseeable future in order to try and boost GDP and inflation amid the novel coronavirus pandemic. Additionally, balance sheets will continue to rise, as will government debt loads.

“As economic output contracts sharply, fiscal outlays surge, and central bank balance sheets double, fiat currencies could come under pressure,” Bank of America analysts wrote in the report. “Investors will aim for gold.

Massive money printing poses serious currency debasement risk, which could push safe-haven assets like gold to unprecedented highs, Celsius founder and CEO Alex Mashinsky told Kitco News.

“People are getting worried about the recovery and the Fed printing trillions of dollars. This is driving an increase in allocation towards gold in many portfolios,” he noted. And sees gold climbing to $3,000 an ounce by the end of next year. But, admits that even more gains are possible depending on how bad the currency debasement gets.

“We have the world’s greatest economic collapse in 100 years the world’s biggest central bank money printing in 100 years and the worst social turmoil in a generation. Gold has been a store of value through good times and bad for 5,000 years. It will continue to fulfill that role for generations to come. It isn’t anybody’s liability, like all the central bank-controlled fiat currencies, that can be printed into oblivion. The Fed is going to flood the market with at least 10 trillion dollars and the central bank added more assets in one month than they did in the last century.”

This is a staggering amount, over 6 times the previous record we saw during the last financial crisis in 2008… When gold surged 123% from $775/oz to $1,920/oz. And from October 2008 to April 2011, Silver soared over 500%, rising from $8.40/oz to $47/oz. When the Federal Reserve printed trillions of fiat currency to save the financial markets, just like what we’re seeing again today.

The Federal Reserve is pumping trillions into the economy and embarking on unlimited quantitative easing. This is going to ignite gold and silver. And make the 2008-2011 run up in prices look small in comparison of what is to come.

To put the debt in contrast, for every ounce of gold mined we are now printing $21,322 and for every ounce of silver mined we create $2,573!

That’s why economist predict this will drive gold to $5,000 an ounce in the years ahead and ultimately to $10,000 based on the amount of fiat currency central banks have printed.

Throughout history the price of gold has always been revalued to account for the amount of currency in circulation.

Washington insider & New York Times best selling author of “Currency Wars” Economist Jim Rickards, who accurately predicted the 2008 Financial Meltdown explains…

“Take global M1 money supply and multiply it by 40%, our official gold backing.Then take that number, and divide it by the official amount of gold in the world, which is about 33,245 tons. In the end, you’ll get about $10,000 an ounce…”

So, a historic realignment of gold prices is coming soon. And the time to prepare is now. The stock market outperformed from 2010 to 2020 – now it is gold’s turn. Below is a breakdown of the recent decades with their preferred assets.

- During the 1990s, the stock market was the place to be. An explosion in Internet stocks led to the dot.com bubble. The Nasdaq rallied from 330 in 1990 to 5100 by 2000.

- During the 2,000s, precious metals and commodities were the best performing assets. Gold rallied from a low of $255 in 2001 to $1,923 by 2011.

- During the 2010s, money flows switched back to the stock market. The DOW bottomed at 6,469 in 2009, and prices topped at 29,600 in February 2020.

- The 2020s favor tangible assets with supply shortages and currency debasement fueling soaring demand.

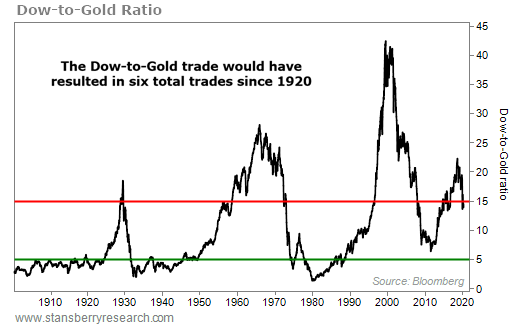

After a 10-year bull market in stocks, the next asset shift is unfolding before our very eyes. That, combined with the 2019 breakout in gold, confirms the next decade heavily favor precious metals and tangible assets. The Dow-to-Gold trade is based on a simple principle.

- You buy stocks when they are cheap relative to gold.

- You sell stocks when they become expensive & return to gold.

Over the course of the last 100 years, you would have made only 6 trades. The chart below shows it all. And if you look carefully, you’ll see a recent reversal…

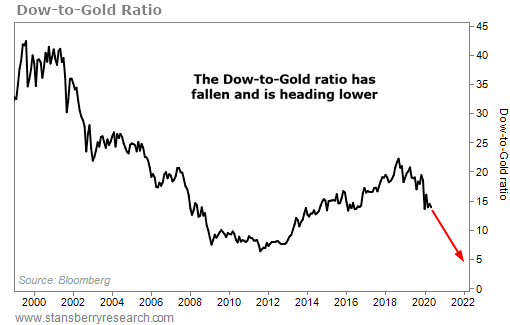

It’s falling again. This is the start of a longer trend… a signal that the system is going to break soon. Maybe it’s starting to break already?

The ratio likes to move in big, clear trends. And once it’s in motion, it tends to stay in motion. And it’s about to head much lower…

The Dow-to-Gold ratio is now back on its way down… to a level somewhere below 5.

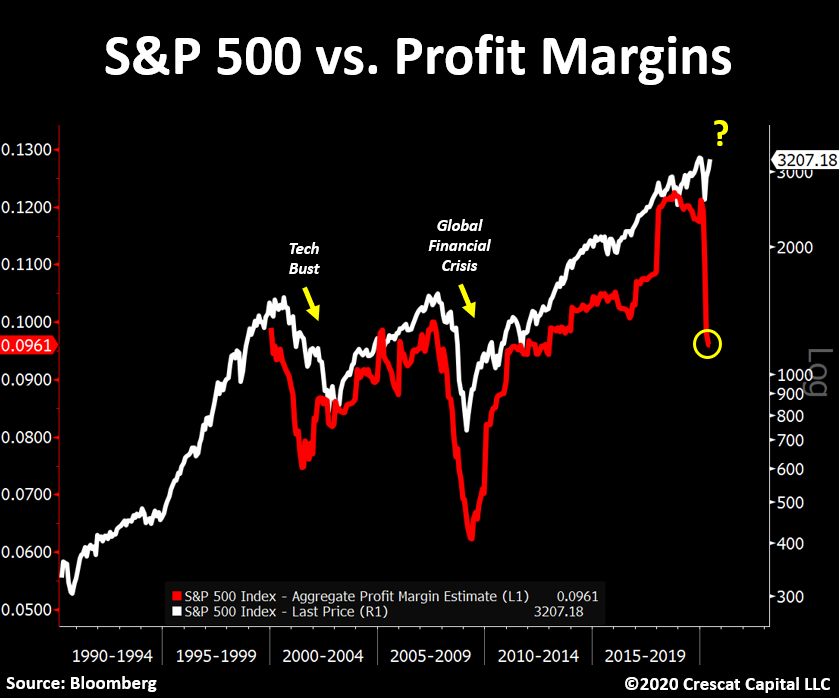

Paul Singer, the hedge-fund billionaire behind Elliott Management, warned that the ultimate path of global stock markets is a drop of at least 50% from February highs.

“The stock market may get cut in half, but this most undervalued asset is about to Surge” the billionaire investor said. “Gold is one of the most undervalued assets available and it’s worth multiples of its current price due to the financial debasement of money by all the worlds central banks.”

This chart shows how disconnected equity prices are from their underlying fundamentals.

There’s never been a better set-up for getting out of overvalued stocks and into undervalued precious metals.

There have been 3 major Gold bull markets in the last 50 years.

“The first one was 1971 to 1980. Gold went up over 2,000%. The second one was 1999 to 2011. Gold went up 655%. We’re in a new bull market that started in 2018. Gold’s up 47% since then. So, 2020 will be a breakout year … we’re actually in the third year of a bull market with a very long way to run.”

Indeed, since gold became legal for U.S. citizens to own again in 1972. Gold has outperformed stocks, the oil price, real estate, bonds and outpaced inflation by a huge margin. It has clearly been a superior alternative to paper money and continues to be the ultimate safe haven and best performing financial asset. In fact, a $25,000 investment at the beginning of this century ( year 2,000 ) has already grown into $175,000 today.

Most importantly, gold provides essential “Financial Insurance” that protects your retirement-savings against equity market declines, asset bubbles, economic meltdowns and currency devaluation. (inflation )

Overvalued equity markets, and a monetary system overcome with indebtedness, is not a safe place to entrust your financial future. Never forget that anything denominated in dollars (stocks, bonds, CD’s) loses value with each passing month.

So, if you haven’t followed our advice to own physical gold and silver yet, this is your chance to reposition 25% -40% of your retirement savings out of dollar denominated investments into Gold & Silver for profits and protection. And there’s never been a better time.

Alert! Due to the corona-pandemic the IRS has extended the 2019 tax filing date to July 15th 🇺🇸.

So, we’re offering a historic price on Proof Silver American Eagle coins. These are the only limited edition bullion coins approved for IRA retirement accounts. They have both collectible and bullion value and have been a favorite for collectors & investors since 1986, when the U.S. government began minting them.

Historically, Proof Silver American Eagles sell for double the price of regular 1/oz silver American Eagles. And, during rising markets, have sold for many times the price of silver bullion coins. The U.S. mint is now selling the 2020 Proof Silver American Eagles for $64.95 per coin, after selling out the entire 2019 mintage for $54.95.

We are offering Proof Silver American Eagles ( dates of our choice) that are qualified for IRA’s 🇺🇸 at our cost of just $45.70 a coin. This is the lowest price in America, and $20 less than the 2020 proof silver American Eagles.

But, our limited quantities will sell out quickly. So, don’t risk disappointment. Call (800) 723-8349 to reserve your proof silver American Eagle coins now, at a historic savings before they sell out. It could be the best investment decision you ever make for your IRA retirement account.

INVEST IN PROOF SILVER AMERICAN EAGLES HERE

Liberty Financial offers wholesale prices, award winning advice & unmatched customer service 🗽.

Since 1982 we have helped thousands of Americans protect and grow their assets with tangible investments. For over 35 years, Liberty Financial & affiliates have been the trusted name in wealth management, with over $1 Billion in customer transactions.

We offer safe & predictable ways to…

- Build your wealth and protect your assets, no matter what happens in the markets.

- Safely fund your IRA/401k retirement accounts with tangible investments.

- Receive 30% more investment value for your money.

- Enjoy capital preservation, privacy and protection.