January 2020.

The U.S. has officially closed the book on a momentous decade as the stock market continues its longest bull run in history. The Dow, the Nasdaq and the S&P 500 are at all-time highs.

Furthermore, it’s been fuelled by artificially low interest rates and trillions of dollars from the Federal Reserve. Creating the largest financial bubble in history.

Everything’s a Bubble: Dallas

Chief Kaplan Admits Fed Is

Inflating Assets.

Everything is a bubble and the worst-kept secret in the finance sector has been officially confirmed: The U.S. Federal Reserve is inflating said bubbles via more quantitative easing.

Everything is a bubble and the worst-kept secret in the finance sector has been officially confirmed: The U.S. Federal Reserve is inflating said bubbles via more quantitative easing.

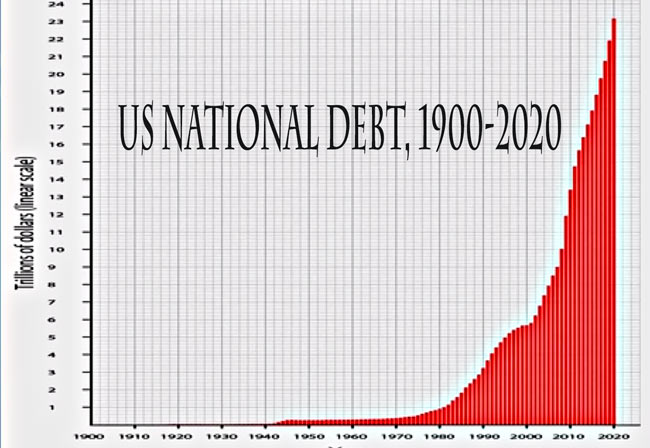

Reuters has dubbed the 2010s the “decade of debt.” Corporate debt, consumer and government indebtedness has skyrocketed over the last 10 years. Sovereign debt around the world has exploded. Total global debt levels are set to hit an all-time high of over $257 trillion. That’s more than triple the world’s entire economic output.

This massive debt bubble poses a significant risk to the financial system and the economy. What this borrowed money has done is inflated the stock, bond & real estate markets and created the illusion of prosperity.

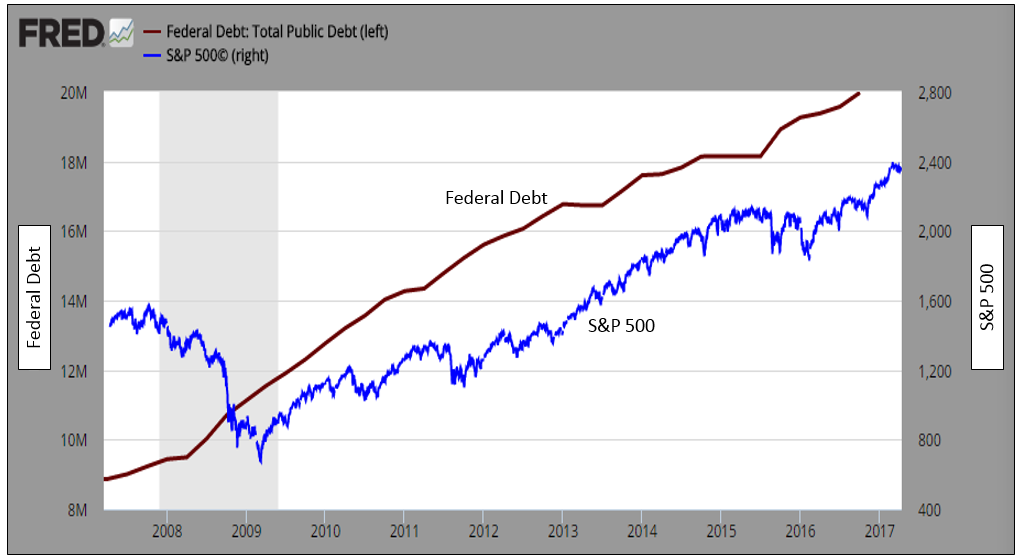

As Reuters put it, “Debt is credited with helping to fuel a decade-long bull market in US equities.”

The Federal Reserve has injected billions of dollars into the economy in order to inflate asset prices, stimulate consumption and investment and suppress unemployment.

The financial markets are now thoroughly dependent on the Fed to keep the bull market going.

The stock market is now directly correlated to Fed liquidity. Without more money printing, the simulation ends and the everything bubble pops.

The Fed hasn’t only incentivized massive indebtedness. It has also blown up debt consumer and government debt bubbles.

Total consumer debt outstanding now stands at a record $4.165 trillion. In a nutshell, American consumers are driving the economy with money they don’t have.

And then we have the massive national debt that has eclipsed $23 trillion, and doubled in the last 10 years. Economists agree, that it’s not a matter of if these debt bubbles pop, but when. And when they do, it will have a devastating impact on the economy.

In fact, if we had to make one prediction for 2020, it’s that unprecedented central bank money printing will fail massively and take the entire bull market with it.

Reliable ‘Buffett Indicator’ Flashing Stock Market Crash Warning! – Few Are Prepared 📉

Warren Buffett indicator

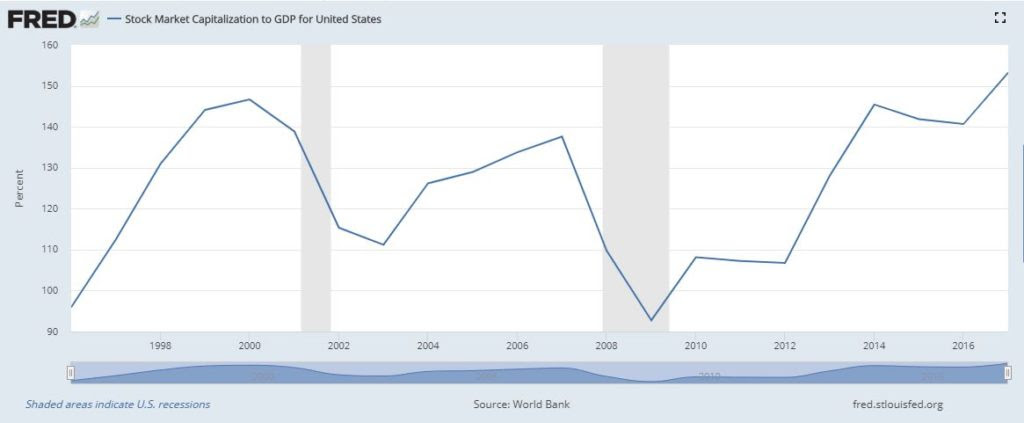

The graph above shows how the Buffett indicator over the past 20 years up until 2017. Before the dot-com bubble crash of the early 2000s, the Buffett indicator showed U.S. market cap was at 146% of GDP. At the end of 2007, prior to the

Great Recession (https://moneyandmarkets.com/10-years-later-americans-great-recession/) market cap was 137% of GDP.

What’s the Buffett indicator at now?

On the first trading day of 2020 the market cap hit a record-high 153%, and rose 14% the last quarter of 2019!

In fact, the S&P 500 hasn’t had a 20% correction in 10.7 years – the longest stretch in 120 years. And U.S. stocks are even more expensive than they were at the 1929 peak.

The record bull run and all-time peak equity valuations, dictate as an investor, you must prepare now by having a strategy in place to protect your retirement savings when the next bubble bursts.

It’s why, we urge investors to reduce exposure from stocks & bonds and increase allocation to tangibles and precious metals.

Investors without an allocation to gold will be wiped out in a stock market crash. Those with a 20% allocation will have survived the storm with their wealth intact.

Example: During the 2008 financial meltdown, gold gained over 25% while stock markets lost more than half of it’s value. And $25k invested in gold (1999-2019) has grown to $150,000 today.

In fact, over the last 50 year’s gold has outperformed stocks, the oil price, real estate, bonds and outpaced inflation by a huge margin. It has clearly been a superior alternative to paper money and continues to be the ultimate safe haven and best performing financial asset.

Most importantly, gold provides essential “Financial Insurance” that protects your retirement-savings against equity market declines, asset bubbles, economic meltdowns and currency devaluation.

(inflation )

The world is filled with inflated markets, financial bubbles, and bloated debt levels in virtually every segment of society. And it’s all taken place within a global monetary system where, for the first known time in history, All currencies are fiat.

This financial and monetary reality has pushed risks high, and not for just investors but savers. It’s crucial that gold and silver comprise a meaningful portion of one’s asset base. A minimum of 20% and up to 40% diversification. Given the nature of similar crises in the past, they will not only preserve purchasing power but lead to extraordinary capital gains.

That’s why prudent investors are repositioning their retirement-savings out of the risky stock market and low yielding Bank accounts, into the safety of gold for profits and protection.

As the top rated wealth management company in the nation 🏆 Our unique and innovative investment strategies provide capital appreciation, preservation, privacy and protection. We offer exclusive opportunities for Investors and savers to safely grow their wealth.

Go to LibertyFinancial.org (https://www.libertyfinancial.org) and discover how to…

* ‘Buy gold once and collect royalties for life.

* Earn 19% annually in the Guaranteed Silver Account.

* Protect IRA & 401k accounts.

* Precious metals savings accounts starting at $100 a month.

These increasingly uncertain financial times require the ultimate form of investment insurance, Gold. Speak to an expert today. Call (800) 723-8349. It could be the best financial decision you make.

Liberty Financial. Trusted Advice. Proven Results. Since 1982 🗽

Copyright © 2019 Liberty Financial, All rights reserved.

You receiving this email because you opted in at our website

godshonestmoney.com (http://www.godshonestmoney.com)

Our mailing address is:

Liberty Financial

P.O. Box 6158

Garden Grove, CA 92846