January 2023

2022 was defined by numerous crises, a tumultuous year that included war, record high inflation, one of the most aggressive interest rate hike cycles in history, a huge spike in the U.S. dollar, a crash in both crypto and stock markets, and the beginning of an economic recession.

In January of last year, we warned investors that inflation would be the #1 financial problem in 2022, bursting the stock, bond and real estate bubbles. And that’s exactly what happened. https://www.

Inflation’s surge from under 2% beginning of 2021 to a peak of 9.1% in the summer of 2022, was dramatic. And it has driven all markets. It drove the Fed into sharp rate hikes, which in turn caused the sharpest selloff in both stocks and bonds since 1981

And just as we forecasted, Gold and silver were remarkably strong in 2022. Despite the Fed’s most aggressive rate-hike cycle in 40 years and the strongest dollar rally since 2015.

By the end of the year, of the major investment classes, only gold, silver and oil logged gains.

Tangible Investments were the big winners in 2022 compared to all other U.S. markets. And the only assets that increased or held their value.

Record demand for Physical gold & silver caused Premiums to Soar on Safe Haven buying, especially classic American coins. Rewarding investors with Double Digit Gains during a time when every other asset class lost value.

Inflation rose to its highest level since the 1980s, forcing the Federal Reserve to raise interest rates at the fastest pace in more than a generation. In 2022 the U.S. central bank increased rates by 4:25%.

The Fed claimed in the spring of 2021 that inflation would be transitory. But 20 months later the CPI was at 7.1%. This led to the most aggressive rate hikes since the 1970’s.

The IMF reported global inflation ended 2022 at 8.8%, almost double the 4.7% reading in 2021.

The traditional 60/40% stock and bond portfolio allocation, saw its worst losses since the 1930’s. As stocks fell to end Wall Street’s worst year in almost a century. The Dow finished down almost 10%, the S&P down about 20%, and the tech heavy Nasdaq down 33%.

The year for stocks is best summarized by chairman of the $635 billion Swiss fund Pictet… “It was one of the most significant years of wealth destruction in nearly 100 years. Looking at it rather simply, many private investors could have lost more than a quarter of their real inflation-adjusted wealth.”

The Wall Street Journal reported that U.S. government bonds suffered the biggest annual decline in history. As the price of bonds fell with stocks due to rising interest rates.

And according to Redfin, home sales fell 35.1% year-over-year in November on a seasonally adjusted basis, the largest decline since it started records. The majority of U.S. homeowners have their wealth in home values, which have lost a cumulative $1.5 trillion of value over the last 6 months.

The majority of U.S. homeowners have their wealth in home values, which have lost a cumulative $1.5 trillion of value over the last 6 months.

In 2023 the #1 problem for investors will be stagnant economic growth combined with rising inflation. (stagflation)

Resulting in historic gains for tangible investments (gold, silver and natural resources) while risk assets (stocks, bonds, mutual funds) and Fiat currency (paper money) will see the greatest losses this year. The U.S. economy has been in an official recession since summer of 2022. Jeff Bezos, Elon Musk, and Charlie Munger have raised the alarm on a US recession. Carl Icahn, Jamie Dimon, and Ken Griffin have also flagged the risk of a painful economic downturn.

The U.S. economy has been in an official recession since summer of 2022. Jeff Bezos, Elon Musk, and Charlie Munger have raised the alarm on a US recession. Carl Icahn, Jamie Dimon, and Ken Griffin have also flagged the risk of a painful economic downturn.

N. Roubini, an NYU economics professor and the CEO of Macro Associates, who is known for correctly predicting the 2008 housing bust and subsequent financial crisis told Bloomberg news. “You’re going to get not only inflation, not only a recession, but what I call the ‘Great Stagflationary Debt Crisis.’ So it’s much worse than the 1970’s, and it’s probably as bad as during the Global Financial Crisis.”

The inversion that we’re seeing now between Treasury yields is the largest we’ve seen since 1981, and has signaled, a recession in 9 out of the last 9 recessions. More than half of the 50 states have falling economic activity now, according to the St. Louis Fed, which provides “reasonable confidence” that the nation as a whole will fall into recession in the near future.

More than half of the 50 states have falling economic activity now, according to the St. Louis Fed, which provides “reasonable confidence” that the nation as a whole will fall into recession in the near future.

The global economy is heading into a decade of low growth, economist says ( CNBC ) “We are going to move into a decade of very, very poor growth in which developed economies are going to find themselves lucky with 1% growth per annum, if they are able to achieve it, and what is more unfortunate than everything else is with elevated levels of inflation.”

In the last stagflation decade, the 1970’s, the stock market lost almost half its value in less than two years. Yet it took almost 20 years for it to recover in real terms.

Flat markets (1906-1924… 1929-1954… 1966-1982… and 2000-2010)… Stagflation in the U.S. was a decade defined as an extended period of poor real returns, says Goldman Sachs. While stocks languished during the stagflationary 1970’s, with negative returns, gold went on a tear rising 1,836%. Silver rose 1,689%.

Stagflation in the U.S. was a decade defined as an extended period of poor real returns, says Goldman Sachs. While stocks languished during the stagflationary 1970’s, with negative returns, gold went on a tear rising 1,836%. Silver rose 1,689%.

Michael Burry (of “The Big Short’ fame) said, “The U.S. is in recession by any definition. The Fed will cut, and the government will stimulate. And we will have another inflation spike.”

“We are currently much closer to the start of the inflation cycle then the end of it. What’s going on today can be compared to the early 1970’s with a lot more inflation to come. The reason is monetary excesses over the past 15 years have been far greater than anything that’s ever happened before. This unprecedented boom in new dollars (money creation) is the direct cause of the inflation that’s now in place. The effect will be unprecedented inflation which will be very bullish for gold.” – Aden Forecast/ Jan 2023

Goldman Sachs is calling for a 43% gain in commodity prices this year, driving retail inflation much higher. The current inflation is the product of the largest money-printing binge in history.

Fed creation of $8 trillion since 2008– $4.5 over just the last couple of years – is the reason why inflation is not going away. You can’t double the amount of dollars in existence without a corresponding devaluation of equal value in the currency.

The core problem for the modern portfolio in 2023 remains debasement of the currency. The official inflation rate (CPI) is 7.1%. But, real inflation using the Labor Department methodology of the 1980s, puts the inflation rate at 15%. The ten-year Treasury yield is 3.5%. This leaves a substantial gap that needs to be breached for investors to achieve a real rate of return.

The official inflation rate (CPI) is 7.1%. But, real inflation using the Labor Department methodology of the 1980s, puts the inflation rate at 15%. The ten-year Treasury yield is 3.5%. This leaves a substantial gap that needs to be breached for investors to achieve a real rate of return.

More rate hikes could lead to a steeper recession and further weakness in stocks, where most 401K’s are invested.

The #1 ranked Aden Forecast say’s,“There have been 14 bear Market since 1929 on average they’ve declined 41%. So, we’re only halfway through this bear market. And in the 5 worst bear markets the average drop was 60%. We believe this could be one of the worst. In fact, stocks are still expensive despite the fall they’ve already had. Because the debt and easy money excesses that proceeded this bear market were totally unprecedented, this bear market has a Lot further to go.”

Where we are in the stock market cycle in January 2023. Since the 1950s, the average time between the Fed’s last rate hike and its first rate cut is a mere 5 months. Some were as short as 1 month, the longest was 13 months.

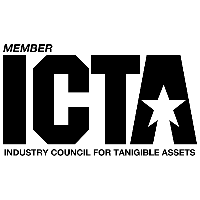

Since the 1950s, the average time between the Fed’s last rate hike and its first rate cut is a mere 5 months. Some were as short as 1 month, the longest was 13 months. In 2023 as the Fed shifts from the highest-velocity tightening period in 40 years toward easing. It’s only a matter of time until we see record high gold prices and historic appreciation versus fiat currencies. As the price of gold rose in all major currencies last year.

In 2023 as the Fed shifts from the highest-velocity tightening period in 40 years toward easing. It’s only a matter of time until we see record high gold prices and historic appreciation versus fiat currencies. As the price of gold rose in all major currencies last year. During the stagflation decade, the 10 year period between 1970 and 1980, gold rose by over 20 times. As paper assets ( stocks, bonds) got clobbered by inflation.

During the stagflation decade, the 10 year period between 1970 and 1980, gold rose by over 20 times. As paper assets ( stocks, bonds) got clobbered by inflation.

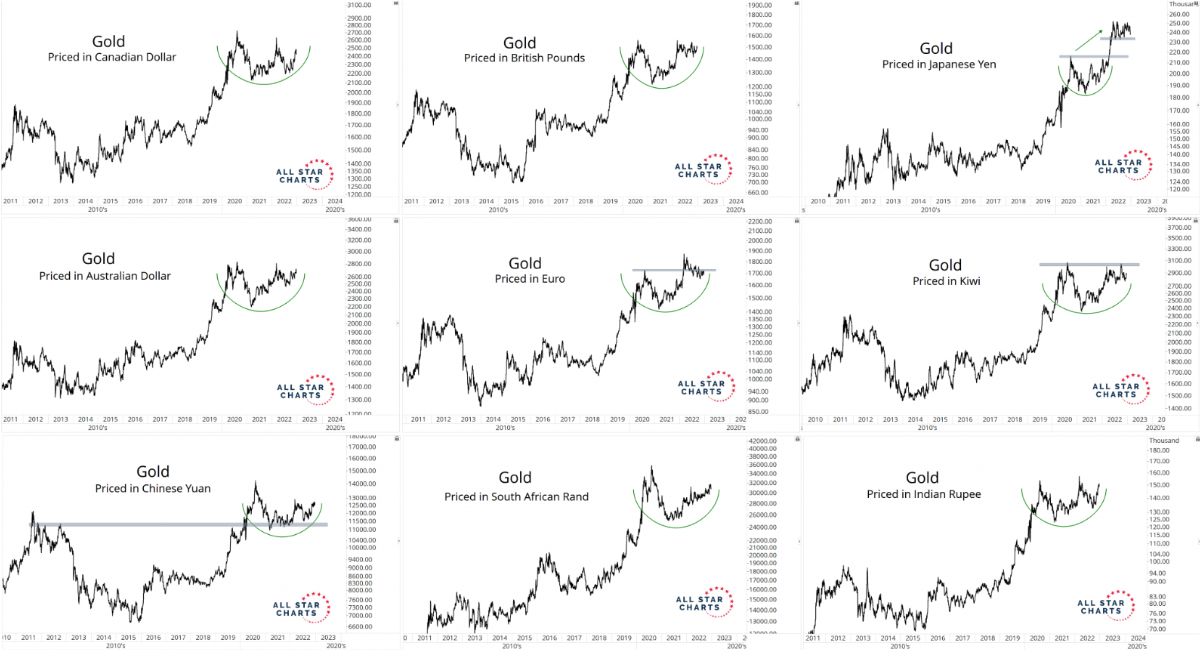

Mike McGlone, Bloomberg senior macro strategist says, “We have a distinctive philosophy around gold. We believe gold has unique risk/reward characteristics that enable it to help preserve real value over the long term.” And should be an essential part of every Investor’s portfolio. Over the past 20 years, paper money has lost an astonishing 80% of its value compared to gold!

Over the past 20 years, paper money has lost an astonishing 80% of its value compared to gold!

It is dangerous to own risk assets such as stocks at artificially inflated valuations. It is especially dangerous to own false safe havens such as bonds, when their yields are so low that they are guaranteed to deliver negative real returns. (inflation )The need for a safe haven asset is clear. The combination of inflation, recession and interest rate risks leave investors with one place to turn. Gold is historically the best choice to balance a portfolio in the current environment.Precious metals are a safe, sound and practical means of preserving and increasing wealth.Investors worldwide rush to gold coins as hedge for the times. Classic American gold & silver coins continue to shine as their performance outpaces equities, real estate, precious metals and most other asset classes. And move forward as just about everything else continues to either flat-line or decline in value. Dwindling supplies and increasing demand assure future price increases.

Classic American gold & silver coins continue to shine as their performance outpaces equities, real estate, precious metals and most other asset classes. And move forward as just about everything else continues to either flat-line or decline in value. Dwindling supplies and increasing demand assure future price increases.

As economic conditions deteriorate in economies around the world and inflation accelerates, it’s citizens are turning to gold at record levels – an indication that the metal has not lost its standing as the favored asset of last resort.

“Demand for gold has never been as high as this year,” says director of the Austrian Mint. “As people rush to find a safe haven for their money amid surging inflation and economic fears caused by the war in Ukraine.” [Reuters/12-14-22)

Limited physical supplies will lead to shortages of nearly all types of bullion coins — and assure higher premiums in 2023.

Central banks around the world, particularly in China, Turkey, and India, have been moving out of dollars and buying more gold at the fastest Pace in nearly 60 years.

Silver demand also reached a new high of 1.21 billion ounces in 2022. In fact, the supply / demand shortfall reached 194 million ounces, the biggest deficit since the 1990s.

The world could run out of gold by 2050 as demand grows to keep up with evolving society, says researchers at (CREAF-CSIC) Issued a warning that the dwindling supply of resources in the face of growing demand means the use of rare-earth elements is unsustainable because of their rarity and the lack of recycling technology.

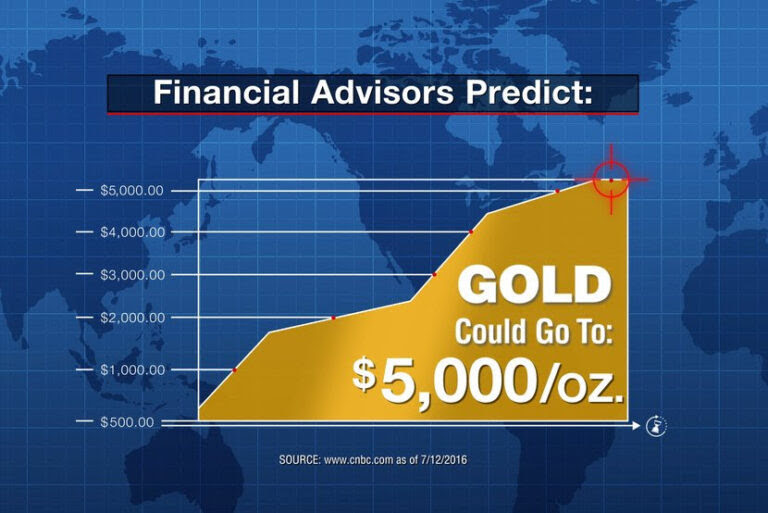

During a currency crisis or 1970’s-style stagflation cycle, a rush to safe havens can produce spectacular bull market gains in gold & silver over and above inflation. Here’s economist’s most compelling Gold price forecasts for 2023…

Here’s economist’s most compelling Gold price forecasts for 2023…

Gold rockets to USD 3,000 as central banks fail on inflation mandate. – 2023 is the year that the market finally discovers that inflation is set to remain ablaze for the foreseeable future.” – Ole S. Hansen.

Saxo’s Head of Commodity Strategy predicted the price of spot gold could exceed $3,000 per ounce in the new year. Steen Jakobsen, chief investment officer at Saxo, told CNBC earlier in the month that he “would not be surprised to see commodity-driven economies wanting to go to gold because of a lack of better alternatives.”

Robert Kiyosaki Predicts Gold Price Soaring to $3,800 While Silver Rises to $75 in 2023.

Rich Dad Poor Dad is a 1997 book authored by Kiyosaki. A New York Times Best Seller it has sold more than 32 million copies. Last week, he warned investors that it may be the last chance for them to buy gold and silver at low prices.

He expects the stock, bond, and real estate markets to crash as the Federal Reserve continues to hike interest rates to fight inflation. He also believes that the U.S. dollar is “toast.” Investors will get richer when the Federal Reserve pivots and prints trillions of “fake” dollars.

Gold prices could surge to $4,000 an ounce in 2023 as recession fears persist. Juerg Kiener, managing director and chief investment officer of Swiss Asia Capital said, “The price of the precious metal could reach between $2,500 and $4,000 sometime next year.” Kiener told CNBC’s Street Signs Asia.

In 2001, the market didn’t just move 20% or 30%, it moved a lot, the same in 2008. Gold went from $600 to $1,800 in no time, so I think we have a very good chance that we see a major move. Many central banks slowing their pace of interest rate hikes make gold instantly more attractive.” He said gold is also the only asset which every central bank owns.

Advice for investors Nikhil Kamath, co-founder of India’s largest brokerage Zerodha, said investors should allocate 20% of their portfolio to gold, adding that it’s a “relevant strategy” going into 2023.

“Gold also traditionally has been inversely proportional to inflation, and it has been a good hedge against inflation,” Kamath told CNBC.

“If you look at how much gold you need to buy a mean home in the 1970’s, you probably require the same or lesser amount of gold today than you did back in the 70s, or the 80s, or the 90s,” he added.

Eric Strand, manager of the ESG Gold Mining ETF, said last month that 2023 would yield a new all-time high for gold and the start of a “new secular bull market. It is our opinion that central banks will pivot on their rate hikes and become dovish during 2023, which will ignite an explosive move for gold for years to come.”

Gold will see extraordinary gains the likes having not been seen since the inflationary 1970’s, when gold & silver prices exploded, while stocks bonds and real estate values declined.

50 Year Chart Puts Gold price at $5,000 to $7,000/oz by 2026 ( #1 Aden forecast) “The explosive phase is still to come in the years ahead. Unprecedented amounts of pandemic money printing has never happened before in history, and gold has not yet reflected the effects of this unparalleled monetary policy. But, it will and when it does the price of both gold and silver will soar to unheard of levels.”

“The explosive phase is still to come in the years ahead. Unprecedented amounts of pandemic money printing has never happened before in history, and gold has not yet reflected the effects of this unparalleled monetary policy. But, it will and when it does the price of both gold and silver will soar to unheard of levels.”

Summary: In 2023 the stock, bond & real estate bubbles will continue to deflate. And money in the bank will lose much of it’s value, as inflation makes our dollars worth less every day. But, gold will continue to protect and grow savings as it has for 5,000 years.

That makes protecting yourself with gold urgent

During the Great Recession in 2008 and 2009. The value of more common stores of wealth like stocks and real estate plummeted. But during that time the price of gold nearly tripled in price, while silver soared 500%. Today is the last great buying opportunity in the world’s cheapest asset.

There is one critical move that every investor must make, to not only survive, but also thrive in 2023…Having assets diversified and properly allocated to gold is the single most important thing you can do with your money this year…

Repositioning 20-30% of your retirement- savings out of risk assets (stocks, bonds) and dollar-denominated accounts (money markets, CDs, annuities) into gold now, will protect your money from equity investment losses, stock market declines, asset bubbles global unrest and currency debasement. ( inflation)

Investors have been diversifying with gold and silver for centuries to limit their exposure to poorly executed monetary and fiscal polices.

These are the times when physical precious metals excel as indispensable safe havens from monetary, economic, and geopolitical turmoil.

Unlike a fiat currency, gold’s value can never be hyperinflated away. Unlike a bond, it can never default. And unlike a publicly traded company (stock) it can never go bankrupt.

Gold is the proven form of asset protection that safeguards your money. It’s value cannot be debased by governments who print paper money at will making their currency worth less each year.

In fact, gold has maintained its value over time better than any other asset on earth. That makes it the best place to store your wealth. It’s the only true safe harbor for your investments, and should be a major part of every investors portfolio.

Gold offers unparalleled profit potential, a proven track record of appreciation, privacy and wealth preservation. It’s the perfect way to protect yourself against inflation and the risky stock market.

That’s why everyday investors and savers make the decision to move away from a declining Dollar and the dangers of Wall Street into the safety of gold.

Since 1982 Liberty Financial has helped thousands of American Secure their financial future by rolling over their IRA/401K out of the risky stock market into tangible Investments that provide a safe and predictable way to build wealth and protect retirement savings.

Our commitment to excellence, award-winning advice and unmatched customer service, has earned us a top consumer investment rating. Making us the wise choice for tangible investments.

As one of the top rated wealth management companies in the nation, we can show you how to use the the dollar devaluation to make once-in-a-generation profits & build your retirement-savings risk free…

* Build your wealth and protect your assets, no matter what happens in the markets.

* Safely fund your IRA/401k retirement accounts with tangible investments.

* Receive up to 25% more investment value at no extra cost.

* Enjoy capital preservation, privacy and protection.

Our exclusive 37% Gold CD Account  Earn 10 times more than a bank CD with a no-risk guarantee. Now you can have the Best of Both Worlds. Unlimited profit potential with a guarantee of principal. The safety of a CD account, with the opportunity to double your retirement savings within 12 months. https://www.libertyfinancial.

Earn 10 times more than a bank CD with a no-risk guarantee. Now you can have the Best of Both Worlds. Unlimited profit potential with a guarantee of principal. The safety of a CD account, with the opportunity to double your retirement savings within 12 months. https://www.libertyfinancial.

PORTFOLIO’S AVAILABLE

$5,000 to $5 Million

CALL TO RESERVE

800-723-8349

LibertyFinancial.org

Trusted Advice. Proven Results. Guaranteed Security. Since 1982

Trusted Advice. Proven Results. Guaranteed Security. Since 1982